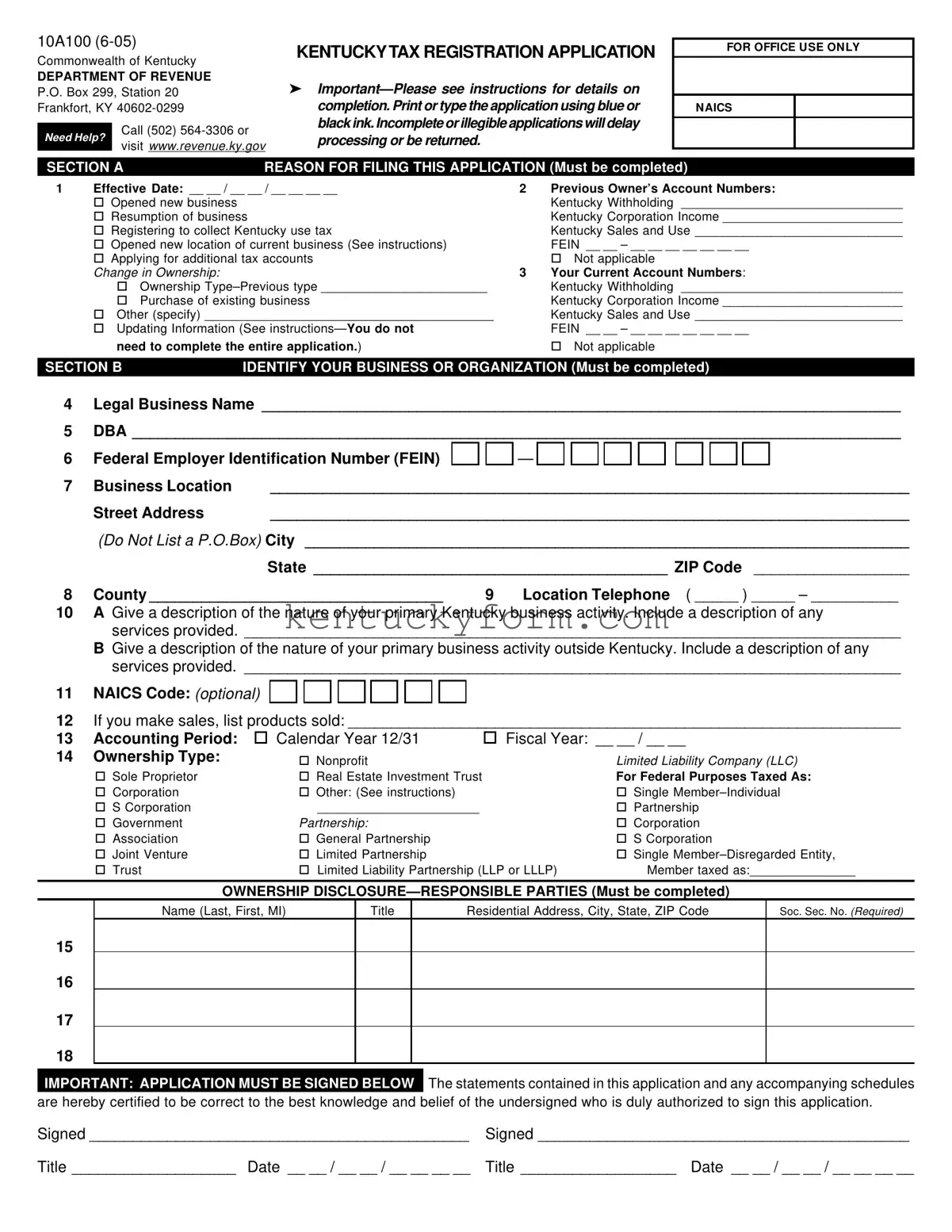

10A100 (6-05)

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

P.O. Box 299, Station 20

Frankfort, KY 40602-0299

|

Need Help? |

Call (502) 564-3306 or |

|

visit www.revenue.ky.gov |

|

|

KENTUCKY TAX REGISTRATION APPLICATION

➤Important—Please see instructions for details on completion. Print or type the application using blue or black ink. Incomplete or illegible applications will delay processing or be returned.

FOR OFFICE USE ONLY

NAICS

SECTION A |

REASON FOR FILING THIS APPLICATION (Must be completed) |

1 |

Effective Date: __ __ / __ __ / __ __ __ __ |

2 |

Previous Owner’s Account Numbers: |

|

Opened new business |

|

Kentucky Withholding ________________________________ |

|

Resumption of business |

|

Kentucky Corporation Income __________________________ |

|

Registering to collect Kentucky use tax |

|

Kentucky Sales and Use ______________________________ |

|

Opened new location of current business (See instructions) |

|

FEIN __ __ – __ __ __ __ __ __ __ |

|

Applying for additional tax accounts |

|

Not applicable |

|

Change in Ownership: |

3 |

Your Current Account Numbers: |

|

|

Ownership Type–Previous type ________________________ |

|

Kentucky Withholding ________________________________ |

|

|

Purchase of existing business |

|

Kentucky Corporation Income __________________________ |

|

Other (specify) _________________________________________ |

|

Kentucky Sales and Use ______________________________ |

|

Updating Information (See instructions—You do not |

|

FEIN __ __ – __ __ __ __ __ __ __ |

|

need to complete the entire application.) |

|

Not applicable |

|

|

SECTION B |

IDENTIFY YOUR BUSINESS OR ORGANIZATION (Must be completed) |

4Legal Business Name __________________________________________________________________________

5DBA _________________________________________________________________________________________

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6 |

Federal Employer Identification Number (FEIN) |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7 |

Business Location |

__________________________________________________________________________ |

|

Street Address |

__________________________________________________________________________ |

|

(Do Not List a P.O.Box) City ______________________________________________________________________ |

|

|

State _________________________________________ ZIP Code __________________ |

8 |

County __________________________________ |

9 |

Location Telephone ( _____ ) _____ – __________ |

10A Give a description of the nature of your primary Kentucky business activity. Include a description of any

services provided. ____________________________________________________________________________

BGive a description of the nature of your primary business activity outside Kentucky. Include a description of any services provided. ____________________________________________________________________________

11 NAICS Code: (optional)

12If you make sales, list products sold: ________________________________________________________________

13 |

Accounting Period: |

Calendar Year 12/31 |

Fiscal Year: __ __ / __ __ |

14 |

Ownership Type: |

Nonprofit |

|

Limited Liability Company (LLC) |

|

Sole Proprietor |

Real Estate Investment Trust |

|

For Federal Purposes Taxed As: |

|

Corporation |

Other: (See instructions) |

|

Single Member–Individual |

|

S Corporation |

_______________________ |

|

Partnership |

|

Government |

Partnership: |

|

Corporation |

|

Association |

General Partnership |

|

S Corporation |

|

Joint Venture |

Limited Partnership |

|

Single Member–Disregarded Entity, |

|

Trust |

Limited Liability Partnership (LLP or LLLP) |

Member taxed as:_______________ |

|

|

|

|

|

OWNERSHIP DISCLOSURE—RESPONSIBLE PARTIES (Must be completed)

Name (Last, First, MI) |

Title |

Residential Address, City, State, ZIP Code |

Soc. Sec. No. (Required) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IMPORTANT: APPLICATION MUST BE SIGNED BELOW The statements contained in this application and any accompanying schedules

are hereby certified to be correct to the best knowledge and belief of the undersigned who is duly authorized to sign this application.

Signed ____________________________________________ |

Signed ___________________________________________ |

Title ___________________ Date __ __ / __ __ / __ __ __ __ |

Title __________________ Date __ __ / __ __ / __ __ __ __ |

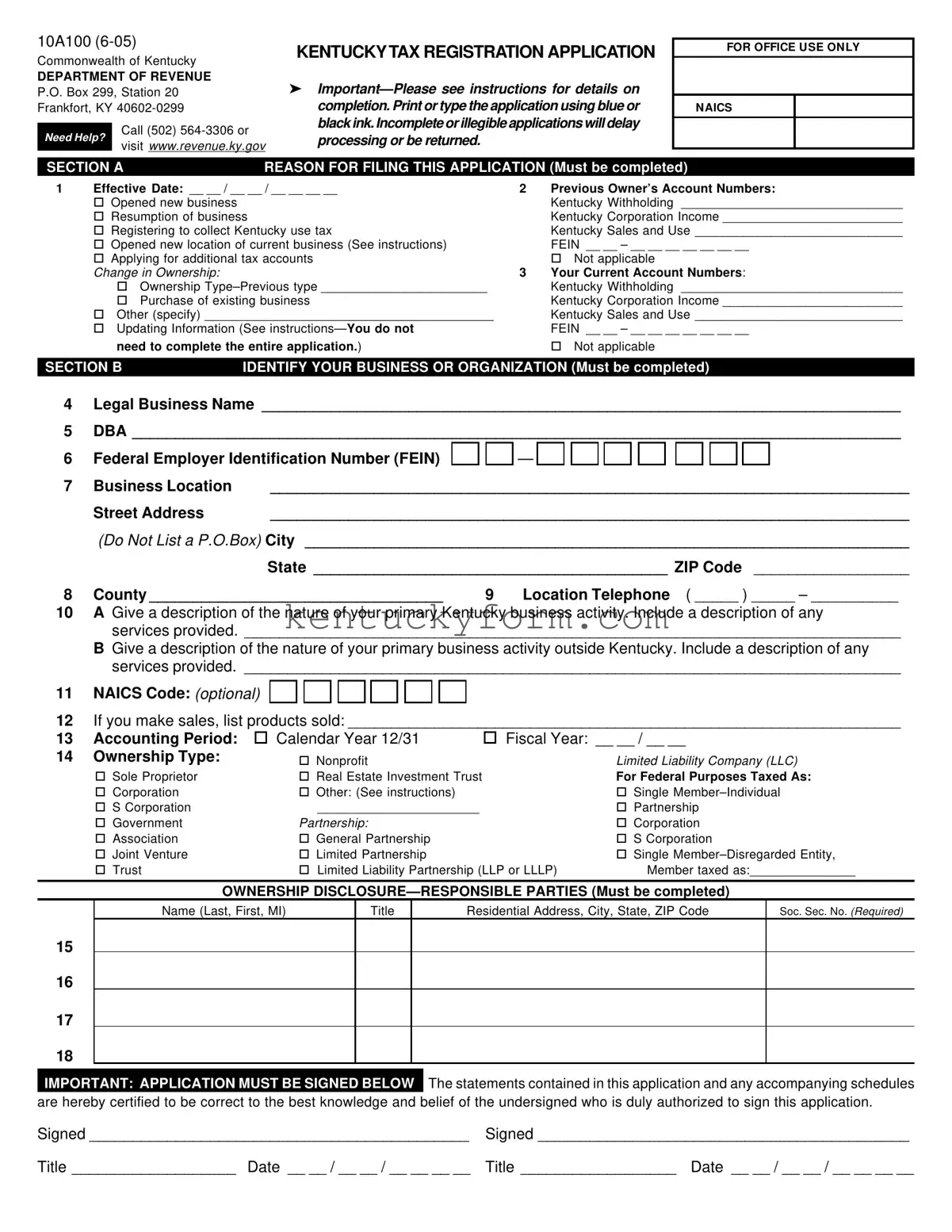

10A100 (6-05) |

|

|

|

Page 2 |

|

|

|

|

|

CONTACT PERSON (Must be completed) |

19 |

Name (print) |

_______________________________ |

20 |

Title ____________________________________________ |

21 |

E-mail Address (optional) ____________________ |

22 |

Daytime |

|

|

(By supplying your e-mail address, you grant the Department of Revenue |

|

Telephone |

( ______ ) ______ – _________ , Ext._______ |

|

permission to contact you via the Internet.) |

23 |

Fax |

( ______ ) ______ – _________ |

|

|

|

|

|

SECTION C |

TELL US ABOUT YOUR BUSINESS OR ORGANIZATION (Must be completed) |

|

|

|

|

|

Yes No |

24Does your business or organization:

A Have employees or will you hire employees to work in Kentucky within the next 6 months? .....................................

B Employ Kentucky residents who work outside the state of Kentucky on which you wish to

voluntarily withhold? .....................................................................................................................................................

(An employee is anyone who works 24 days or more during a quarter OR earns more than $50 a quarter. This includes family members who receive wages.)

25If your business is a corporation or a limited liability company choosing taxation as a

corporation for federal purposes, do or will the officers receive compensation other than dividends? ..........................

If you answered “Yes” to EITHER question 24 or 25, or are adding an additional account, you must complete Section D.

26Does or will your business or organization:

A Make retail sales? ..........................................................................................................................................................

B Make wholesale sales? .................................................................................................................................................

27Does or will your business or organization:

A Install repair or replacement parts in tangible personal property? (See instructions) .................................................

B Produce, fabricate, process, print or imprint tangible personal property? (See instructions) .....................................

28Does or will your business or organization rent or lease tangible personal property to others,

including related companies? (See instructions) ..............................................................................................................

29Does or will your business or organization charge taxable admissions? (See instructions) ...........................................

30Does or will your business or organization rent temporary lodging to others? ................................................................

31Do or will you sell for or are you a manufacturer’s agent who solicits orders for a nonresident

seller not registered in Kentucky? (See instructions) .......................................................................................................

32Does or will your business sell: (Check all that apply)

A Coal ..............................................................................................................................................................................

B Other minerals ..............................................................................................................................................................

C Water ............................................................................................................................................................................

D Natural, artificial or mixed gas .....................................................................................................................................

E Electricity ......................................................................................................................................................................

F Communication services ..............................................................................................................................................

G Sewer services .............................................................................................................................................................

Yes No

H Cable services ..........................................................................................

I Satellite broadcast services ......................................................................

If you answered “Yes” to ANY of questions 26 through 32 (except 32H or 32I), or are adding an additional account, you must complete Section E AND you may SKIP questions 33-35.

33 Is your business or organization a construction company (contractor) that brings equipment

into Kentucky for use? .......................................................................................................................................................

34 Is your business or organization a construction company (contractor) that brings into this state

construction materials or supplies on which no Kentucky sales tax or equivalent has been paid? ................................

35 Does or will your business or organization make purchases from out-of-state vendors and not pay

Kentucky sales or use tax to the seller on those purchases? ..........................................................................................

➤ If you are a professional service business, please see instructions for important additional details.

If you answered “Yes” to ANY of questions 33 through 35, you must complete Section F.

36 Is your business or organization a corporation, S corporation, limited partnership, limited liability partnership (LLP), limited liability company (LLC), professional limited liability company (PLLC), real estate investment trust (REIT), regulated investment company (RIC), real estate mortgage investment conduit (REMIC), financial asset securitization investment trust (FASIT) or similar entity created with limited liability for the partners, members

or shareholders? ................................................................................................................................................................

The 2005 Kentucky General Assembly enacted legislation that defines corporations to include the companies listed above. The legislation requires these entities to file a Kentucky corporation income tax return for periods beginning on or after January 1, 2005, regardless of how they file with the Internal Revenue Service. These entities must apply for a Kentucky Corporation Income Tax Account.

If you answered “Yes” to question 36, you MUST answer questions 37 through 45 AS IF YOUR BUSINESS OR ORGANIZATION

IS A CORPORATION. Sole proprietorships and general partnerships may SKIP questions 37 through 45.

Yes No

37Is your corporation organized under the laws of Kentucky? .............................................................................................

38Does or will your corporation have its commercial domicile in Kentucky? (See instructions) .........................................

39Does or will your corporation own or lease any real or tangible personal property located in Kentucky? ...................................

40Does or will your corporation have one or more individuals performing services in Kentucky? .....................................

41Does or will your corporation maintain an interest in a general partnership doing business in Kentucky? ....................

42Does or will your corporation derive income from or attributable to sources within Kentucky, including deriving income directly or indirectly from a trust doing business in Kentucky? ............................................................................

43Does or will your corporation direct activities at Kentucky customers for the purpose of selling them goods or services? ............................................................................................................................................................................

44Does your corporation own or lease any intangible property in Kentucky such as royalties, franchise

agreements, patents, trademarks, etc.? (See instructions) ..............................................................................................

45Is your business or organization a homeowner’s association? ........................................................................................

If you answered “Yes” to ANY of questions 37 through 45, you must complete Section G.

46 |

Did you purchase an existing business? (See instructions) |

.......................................................................................... |

|

|

SECTION D |

EMPLOYER’S WITHHOLDING ACCOUNT |

(Must be completed if you answered “Yes” to question 24 OR 25, or you are registering for an additional account.) |

47 |

Number of employees in Kentucky |

________________________________________________ |

48 |

Date wages first paid |

|

___ ___ /___ ___ /____ ____ ____ ____ |

49 |

Estimated quarterly withholding in Kentucky |

$ ______________________________________________ |

50 |

Send mail related to this account to |

|

|

Same address as in Page 1, Section B, Item 7 |

|

|

Mailing address ATTN ______________________ |

Street ___________________________________________ |

|

|

|

________________________________________________ |

|

|

|

City ____________________________________________ |

51County _____________________________________ State, ZIP Code ___________________________________

52Mail address telephone (_____ ) _______ – ________________

SECTION E |

SALES AND USE TAX ACCOUNT |

(Must be completed if you answered “Yes” to ANY of questions 26 through 32G, or you are registering for an additional account. )

53 |

Date sales began or will begin |

___ ___ /___ ___ /____ ____ _____ ____ |

54 |

Accounting method |

Cash |

Accrual |

55 |

Do you rent temporary lodging to others? |

Yes |

No |

56 |

Do you sell new tires for motor vehicles? |

Yes |

No |

57 |

Estimated gross monthly sales |

$ ________________________________ |

58 |

Send mail related to this account to |

|

|

|

Same address as in Page 1, Section B, Item 7 |

|

|

|

Same address as in Section D, above |

|

|

|

Mailing address ATTN ______________________ |

Street ___________________________________________ |

|

|

________________________________________________ |

|

|

City ____________________________________________ |

59County _____________________________________ State, ZIP Code ___________________________________

60Mail address telephone (______ ) ________ – ______________

SECTION F |

CONSUMER’S USE TAX ACCOUNT |

(Must be completed if you answered “Yes” to ANY of questions 33 through 35.)

61 |

Date purchases began or will begin |

|

(If you make a one-time purchase only, see instructions.) |

___ ___ /___ ___ /____ ____ ____ ____ |

62 |

Send mail related to this account to |

|

|

Same address as in Page 1, Section B, Item 7 |

|

|

Same address as in Section D, above |

|

|

Mailing address ATTN ______________________ |

Street ___________________________________________ |

|

|

________________________________________________ |

|

|

City ____________________________________________ |

63County _____________________________________ State, ZIP Code ___________________________________

64Mail address telephone (______ ) ________ – ______________

10A100 (6-05) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION G |

|

|

|

|

|

|

|

CORPORATION INCOME TAX ACCOUNT |

(Must be completed if you answered “Yes” to ANY of questions 37 through 45.) |

65 |

Date of incorporation or organization |

___ ___ /___ ___ /____ ____ ____ ____ |

66 |

State of incorporation or organization |

_________________________________ |

67 |

Date of qualification in Kentucky |

___ ___ /___ ___ /____ ____ ____ ____ |

68 |

Is this corporation a member of an affiliated corporate group? |

|

Yes |

The Common Parent Name Is ____________________________________________ |

|

|

DBA ________________________________________________________________ |

|

|

Address ______________________________________________________________ |

|

|

City, State, ZIP Code ___________________________________________________ |

|

|

FEIN |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Start Date _____ /_____ |

|

|

|

|

|

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

69 |

Send mail related to this account to |

|

|

|

|

|

Same address as in Page 1, Section B, Item 7 |

|

|

|

|

|

Same address as in Section D, on Page 3 |

|

|

|

|

|

Mailing address ATTN ______________________ |

Street ____________________________________________ |

________________________________________________________

City _____________________________________________

70County _____________________________________ State, ZIP Code ____________________________________

71Mail address telephone (______)_______ – ________________

For assistance in completing the application, please call the Taxpayer Registration Section at (502) 564-3306, Monday through Friday between the hours of 8 a.m. and 4:30 p.m., Eastern time, OR you may call or visit one of the following Kentucky Taxpayer Service Centers or the Telecommunication Device for the Deaf.

Each office is open Monday through Friday, 8 a.m. to 4:30 p.m., local time.

Ashland |

(606) 920-2037 |

Northern Kentucky |

(859) 371-9049 |

Bowling Green |

(270) 746-7470 |

Owensboro |

(270) 687-7301 |

Central Kentucky |

(502) 564-4580 |

Paducah |

(270) 575-7148 |

Corbin |

(606) 528-3322 |

Pikeville |

(606) 433-7675 |

Hopkinsville |

(270) 889-6521 |

Telecommunication |

|

Louisville |

(502) 595-4512 |

Device for the Deaf |

(502) 564-3058 |

Mail completed application |

Kentucky Department of Revenue |

|

consisting of ALL 4 pages to: |

P.O. Box 299, Station 20 |

|

|

|

Frankfort, Kentucky 40602-0299 |

|

OR fax completed application |

ATTN: Taxpayer Registration Section at (502) 227-0772 |

consisting of ALL 4 pages to: |

|

|

For information about registering for coal severance tax, cigarette tax, minerals or natural gas severance tax, motor fuels tax, utility gross receipts license tax or any other tax administered by the Department of Revenue, please visit our Web site at www.revenue.ky.gov.

If you are applying for a withholding account and/or a sales and use tax account and would like to receive a packet to register for Electronic Funds Transfer (EFT), please call (502) 564-6020.

The DOR has an Ombudsman’s Office to serve as your advocate and is available to make sure your rights are protected. You may contact the Ombudsman’s Office at (502) 564-7822.

This form does not include registration for Unemployment Insurance or Workers’ Compensation Insurance. Please con- tact the Business Information Clearinghouse toll free at 1-800-626-2250 (in Kentucky) or (502) 564-4252 (outside Kentucky) to obtain information on these taxes or contact the offices directly at the numbers below.

Unemployment Insurance |

(502) 564-2272 |

Secretary of State |

(502) 564-2848 |

Workers’ Compensation |

(502) 564-5550 |

IRS—FEIN |

(800) 829-4933 |

The Kentucky Department of Revenue does not discriminate on the basis of race, color, national origin, sex, religion, age or disability in employment or the provision of services.