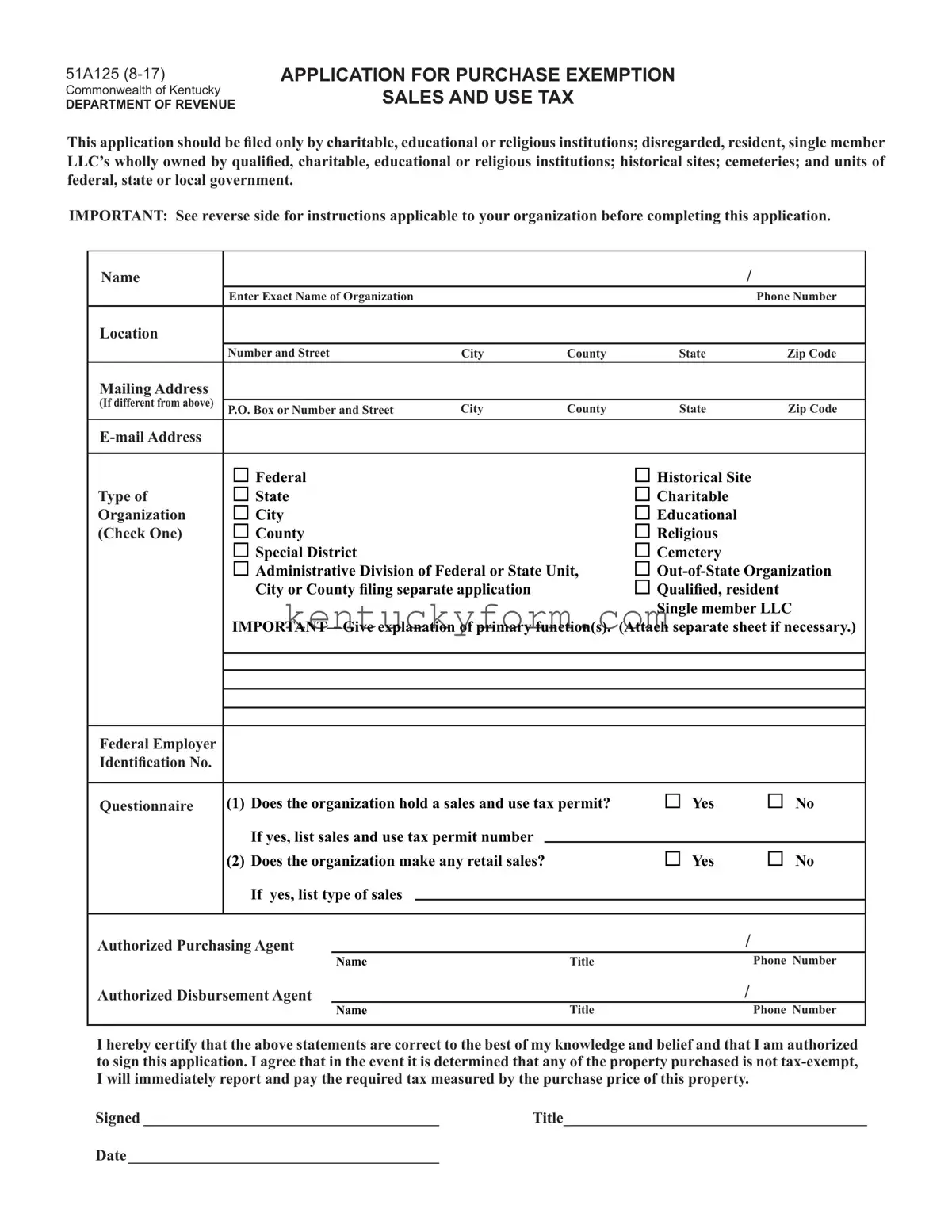

SPECIAL INSTRUCTIONS

Charitable, Educational and Religious Institutions and Qualified, Resident Single Member LLC’s

(1)A copy of the Articles of Incorporation;

(2)detailed schedule of receipts and disbursements must be attached to this application.

(3)The letter from the Internal Revenue Service which determines that your organization is exempt from income taxation under Section 501(C)(3) of the Internal Revenue Code must be attached to this application.

Historical Sites

(1)A copy of the letter from the Kentucky Heritage Commission confirming your listing in the National Register must be attached to this application.

(2)Admission charges to historical sites qualifying for exemption are not subject to sales tax. However, historical sites are liable for tax on any other retail sales such as meals, arts and crafts, souvenirs, etc.

Units of Federal, State or Local Government

(1)Units of local government include cities, counties and all special districts as defined in KRS 65.005.

(2)Special districts must attach a copy of the registration filed with the county clerk as required by KRS 65.005.

(3)Each administrative division within a federal or state unit, city or county which performs a specific function and makes purchases in its own name is required to file a separate application.

Cemeteries

(1)A copy of the Articles of Incorporation and a detailed schedule of receipts and disbursements must be attached to this application.

(2)Attach a copy of the ruling which grants the organization an exemption from property tax.

IF YOUR APPLICATION IS APPROVED

(1)You will be permitted to make purchases of tangible personal property, digital property or services without payment of sales and use tax to the supplier. However, purchases of any items not to be used within the exempt function of the organization are taxable.

(2)Aletter of authorization will be mailed to you which will contain an exemption number and instructions for properly claiming the exemption on purchases.

(3)If the organization makes taxable sales and is not an educational or charitable institution, a sales and use tax permit is required.

OUT–OF–STATE ORGANIZATION

In addition to the above, you must submit a copy of the exemption letter or authorization to show proof of exemption from sales tax in your state.

IMPORTANT: The Department of Revenue must be notified promptly of any change in the name, address or nature of the organization

from the information submitted in this application. Please refer to the purchase exemption number issued to the organization when corresponding with the Department.