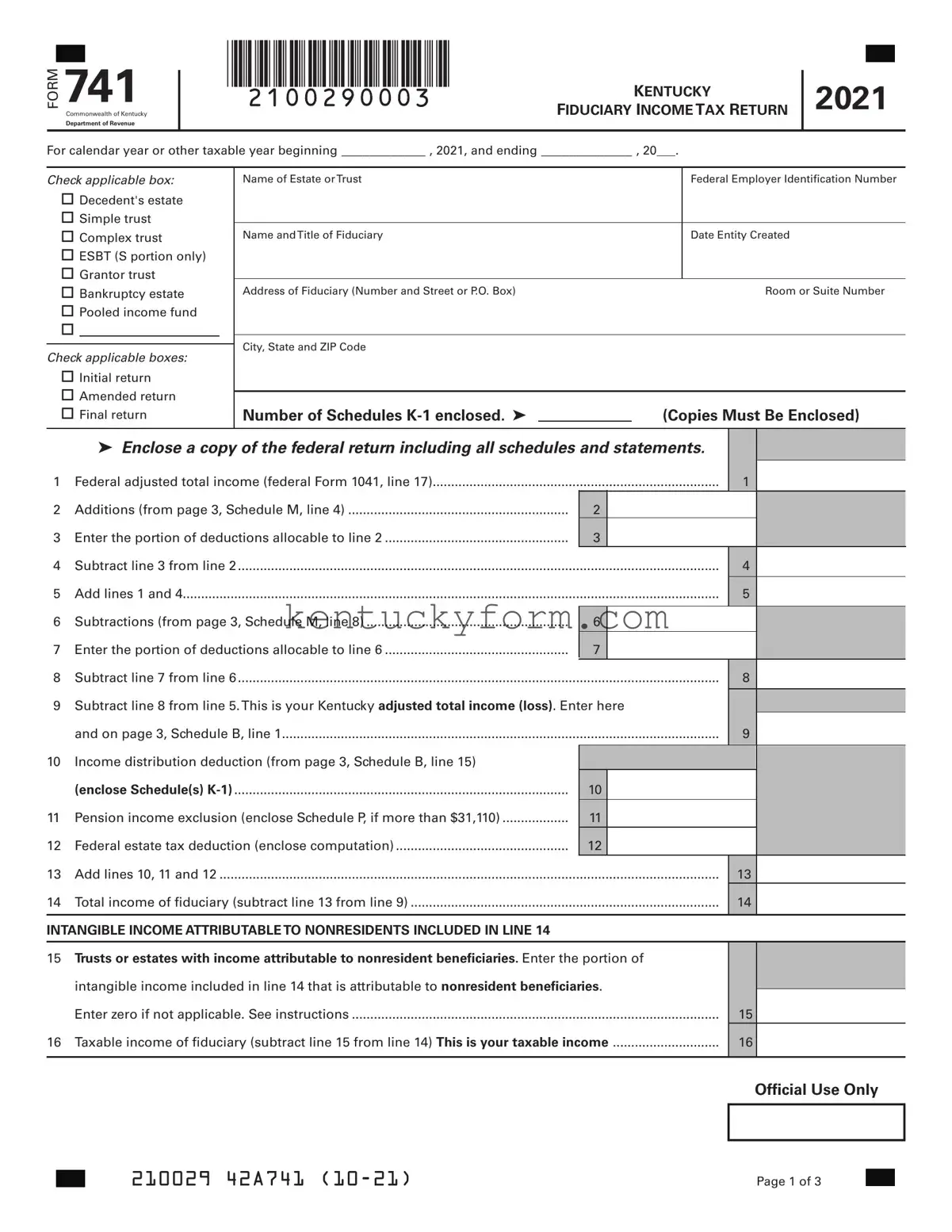

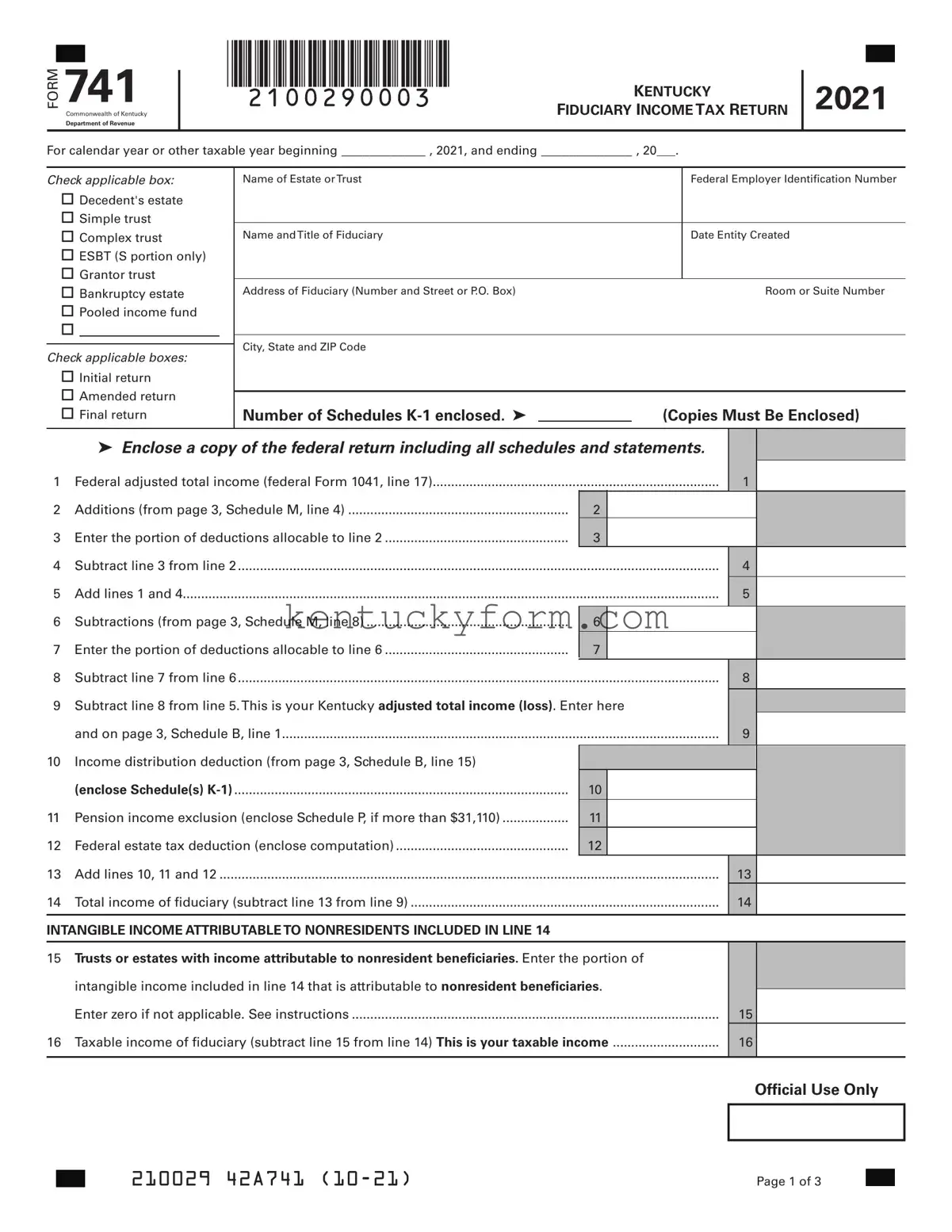

The 741 Kentucky Fiduciary Income Tax Return is closely related to the Federal Form 1041, U.S. Income Tax Return for Estates and Trusts. Both documents are used to report income, deductions, and gains or losses managed by fiduciaries on behalf of an estate or trust. They require similar information, such as the entity's identification number, the fiduciary's name and address, and a detailed accounting of the income distributions made during the tax year. However, while Federal Form 1041 applies to filings across the United States, the 741 form is specifically tailored to meet Kentucky's state tax requirements.

Another document resembling Form 741 is the Schedule K-1, which details the share of income, deductions, and credits allocated to beneficiaries of trusts or estates. While the Schedule K-1 provides individual breakdowns to beneficiaries about their respective portions, Form 741 compiles the overall fiduciary activities to be reported to the Kentucky Department of Revenue. The connection lies in the need to attach copies of Schedule K-1 to the Form 741 to ensure the amounts reported at both the entity and individual beneficiary levels are consistent.

The Federal Schedule D (Form 1041), Capital Gains and Losses, is similar to parts of Form 741 that deal with reporting capital gains or losses from the estate or trust. Both documents are essential for accurately capturing the financial activities related to investments held by the entity. They ensure that any capital gains or losses impacting the fiduciary’s taxable income are correctly reported to the tax authorities, albeit one focuses on federal tax implications and the other on Kentucky state tax requisites.

Form 4972-K, Kentucky Tax on Lump-Sum Distributions, shares similarities with Form 741 in the context of how specific types of income are taxed under Kentucky law. When an estate or trust receives a lump-sum distribution that qualifies for special tax treatment, the details of this distribution and its tax calculation would influence the information reported on Form 741. Both forms contribute to the delineation of specialized income categories and their respective tax treatments within the state of Kentucky.

Schedule RC-R, Related to Credits and Incentives, also parallels the 741 form in the way it deals with reducing the tax obligation through applicable credits. While Form 741 serves as the primary document for fiduciary income reporting, the Schedule RC-R allows for the detailing of credits that the fiduciary might be eligible for, thus directly impacting the final tax calculated on Form 741. This demonstrates the interconnectedness of Kentucky’s tax forms in optimizing an estate or trust’s tax liabilities.

Schedule M (FORM 741) strongly correlates with the main body of Form 741 since it directly supplements it with details about additions to and subtractions from federal adjusted total income to arrive at Kentucky adjusted total income. This schedule reflects the modifications necessary to reconcile the differences between federal and state taxable income, showcasing the meticulous process of state-specific income tax calculation for fiduciaries.

The Federal Estate Tax Computation form (often included in filings alongside the Federal Form 1041) is akin to the sections within Form 741 that relate to deductions like the Federal estate tax deduction. Both seek to reconcile the estate’s tax obligations across different government levels, providing mechanisms to avoid double taxation on the same income streams. While they operate within their respective tax jurisdictions, their goals align in ensuring fair and accurate tax practices are applied to estates and trusts.

Finally, the Kentucky Passive Activity Loss Limitations (Form 8582-K) relate to Form 741 through the specific treatment of passive activity losses. Similar to the nuanced treatment of different income and loss types, Form 8582-K’s results feed into the preparation of Form 741, ensuring that only the allowable losses according to Kentucky’s tax laws are applied, affecting the taxable income reported by the fiduciary. This interaction exemplifies the layered approach to handling complex fiduciary tax situations.