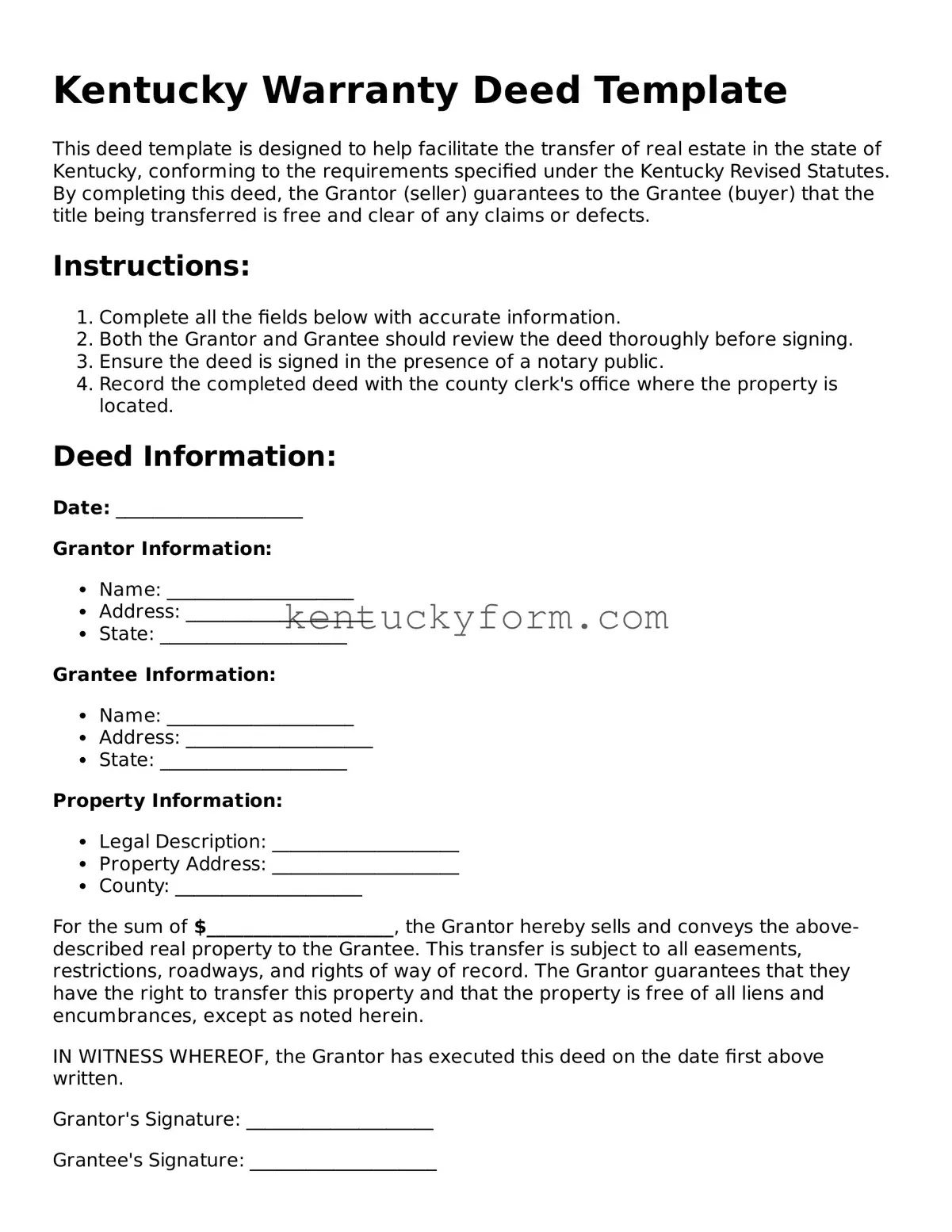

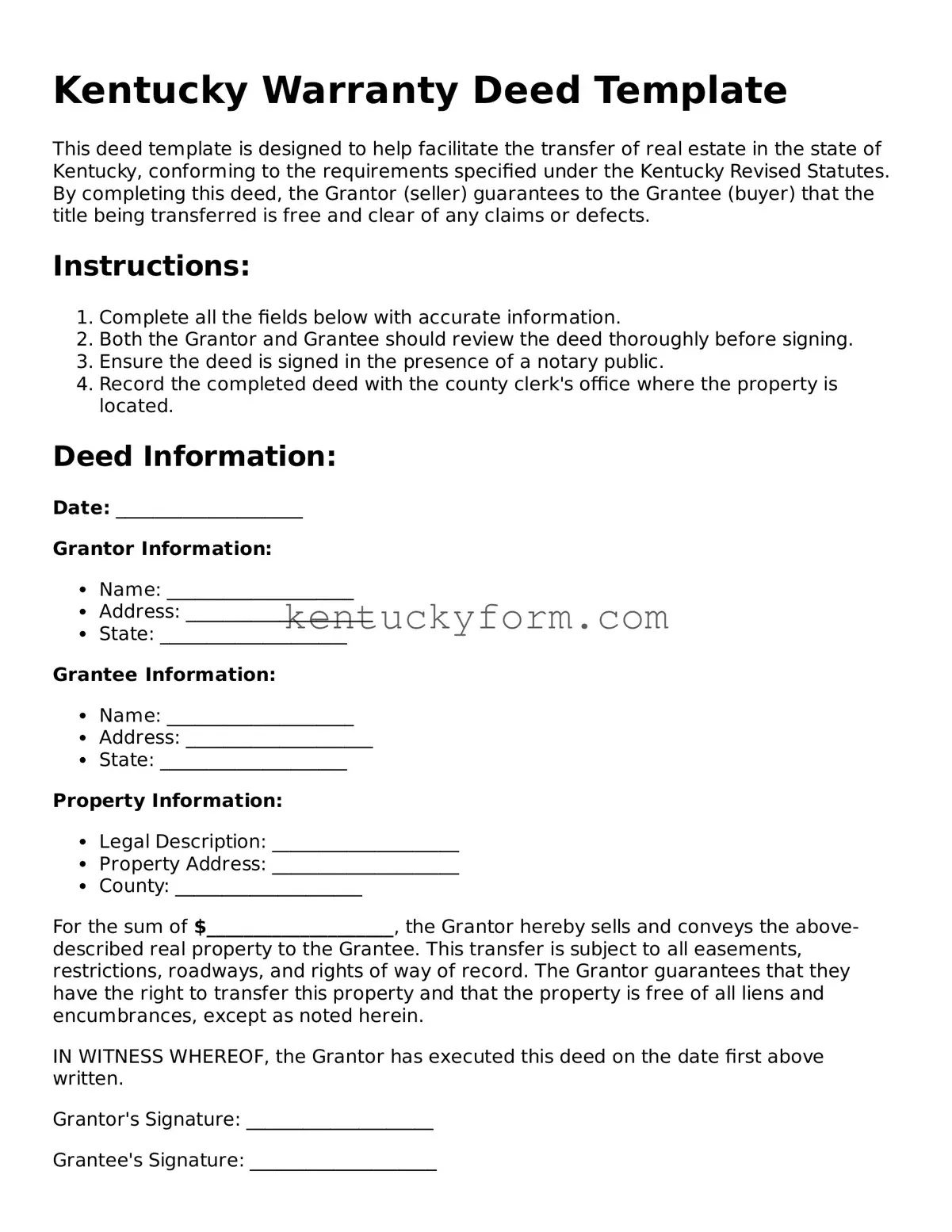

Free Deed Form for the State of Kentucky

The Kentucky Deed form is a crucial document used to transfer ownership of real estate from one party to another. It meticulously outlines the terms and conditions under which this significant exchange takes place, ensuring both parties are well-informed and agreeable. For those looking to navigate this essential step in property transaction smoothly, click the button below to fill out your Kentucky Deed form with ease.

Modify Document

Free Deed Form for the State of Kentucky

Modify Document

Modify Document

or

Free Deed File

One quick step left to finish

Edit, save, and download Deed online with ease.