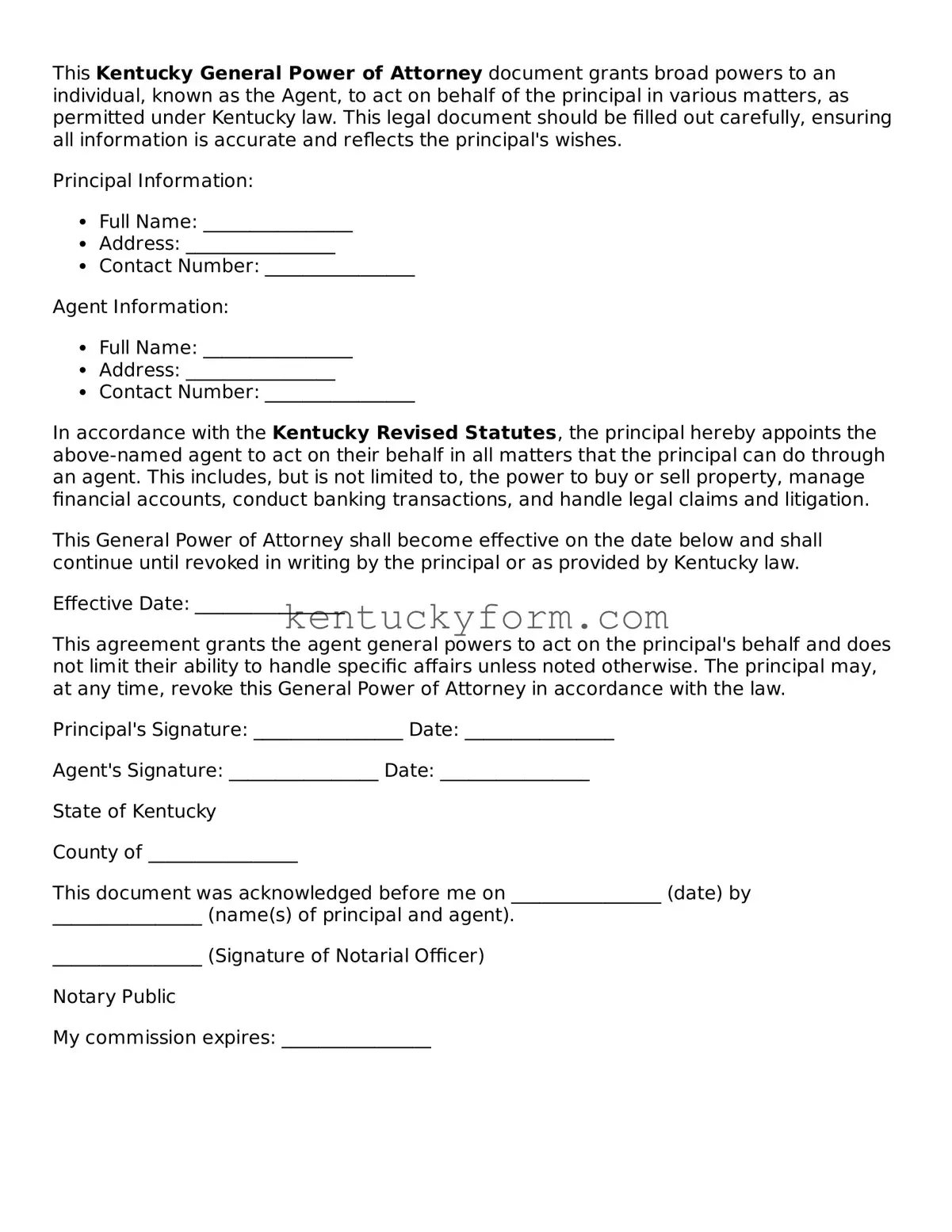

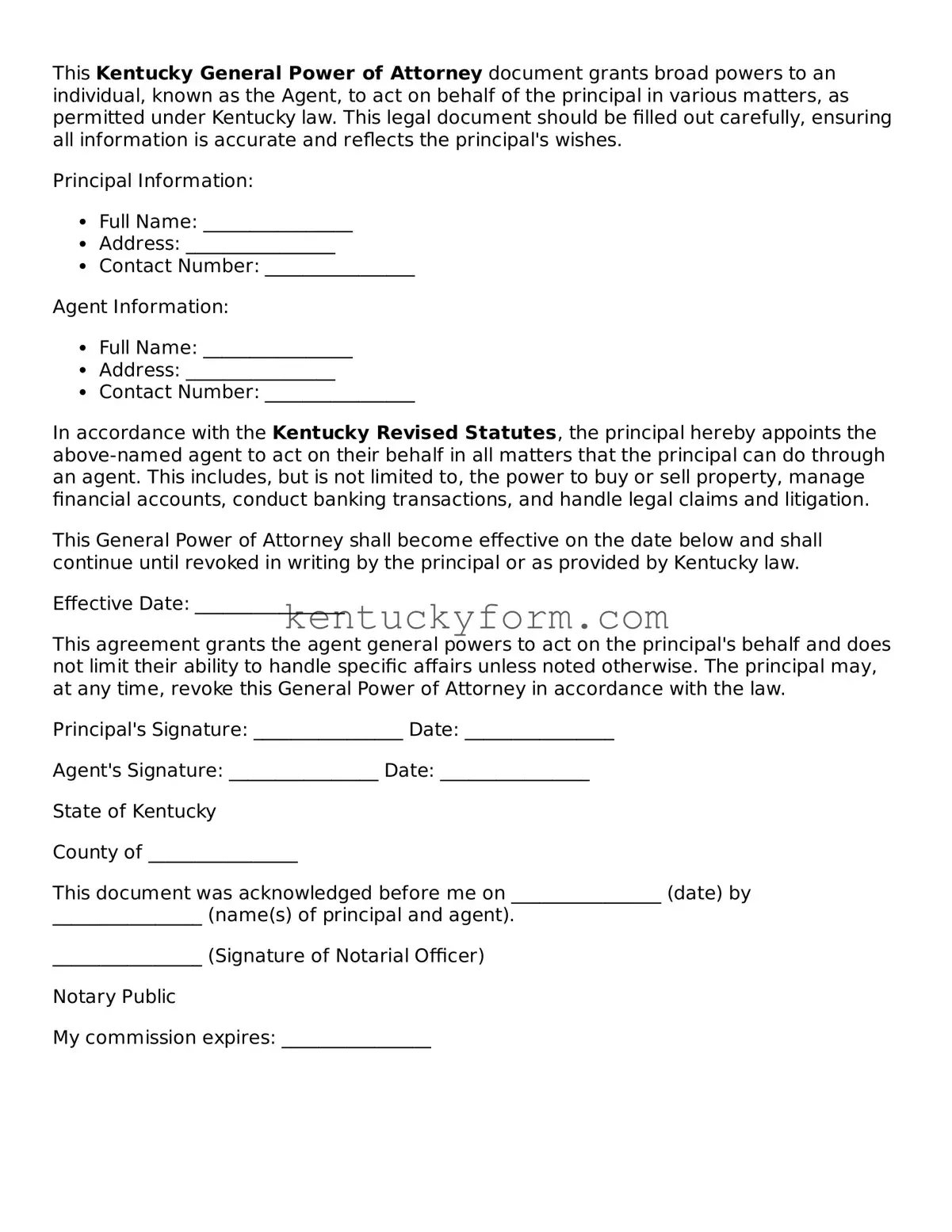

Free General Power of Attorney Form for the State of Kentucky

The Kentucky General Power of Attorney form is a legal document that allows an individual to grant broad powers to another person, known as an agent, to handle their financial affairs. This can include buying or selling property, managing bank accounts, and dealing with taxes, among other responsibilities. For anyone needing to ensure their financial matters are handled without interruption, completing this form is a critical step. Click the button below to fill out your Kentucky General Power of Attorney form securely and efficiently.

Modify Document

Free General Power of Attorney Form for the State of Kentucky

Modify Document

Modify Document

or

Free General Power of Attorney File

One quick step left to finish

Edit, save, and download General Power of Attorney online with ease.