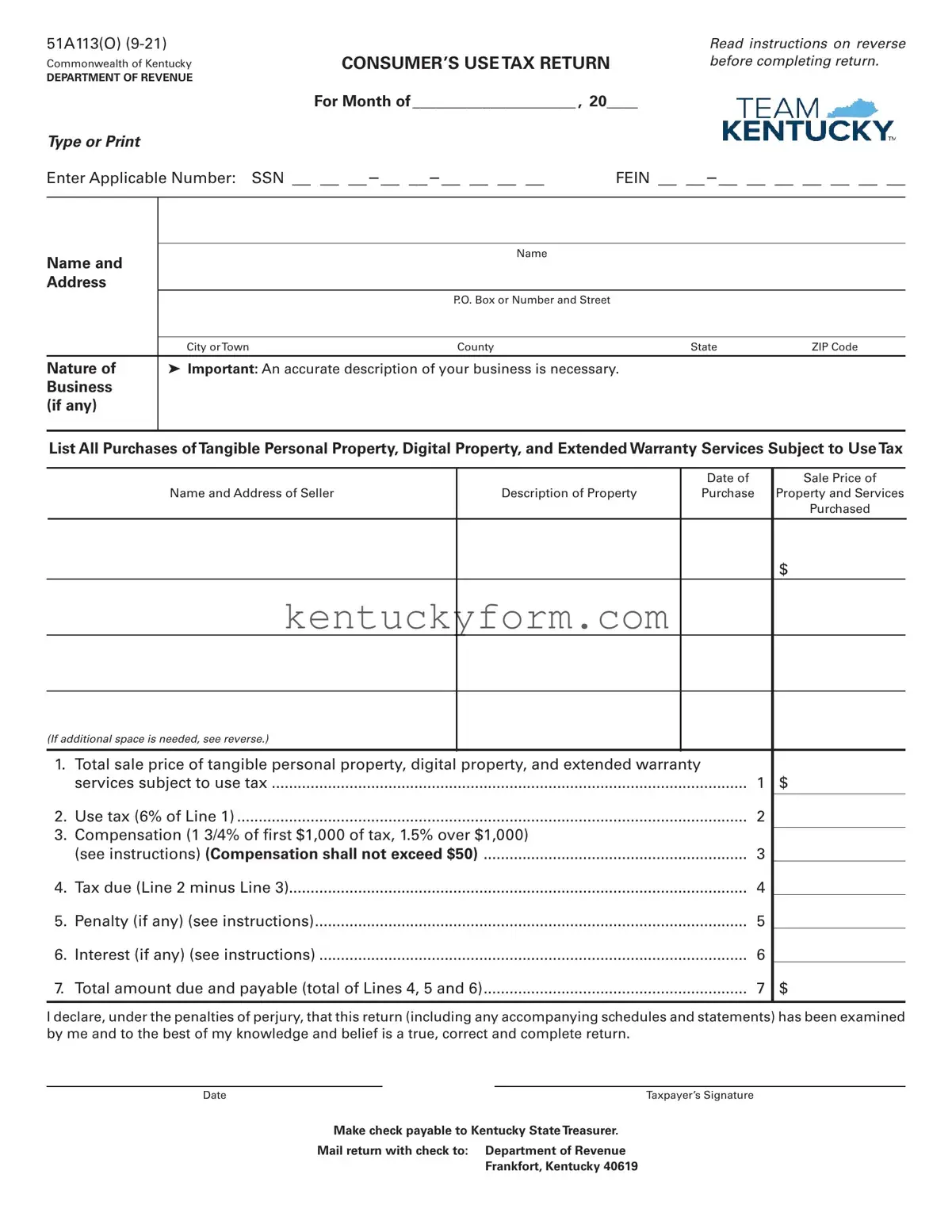

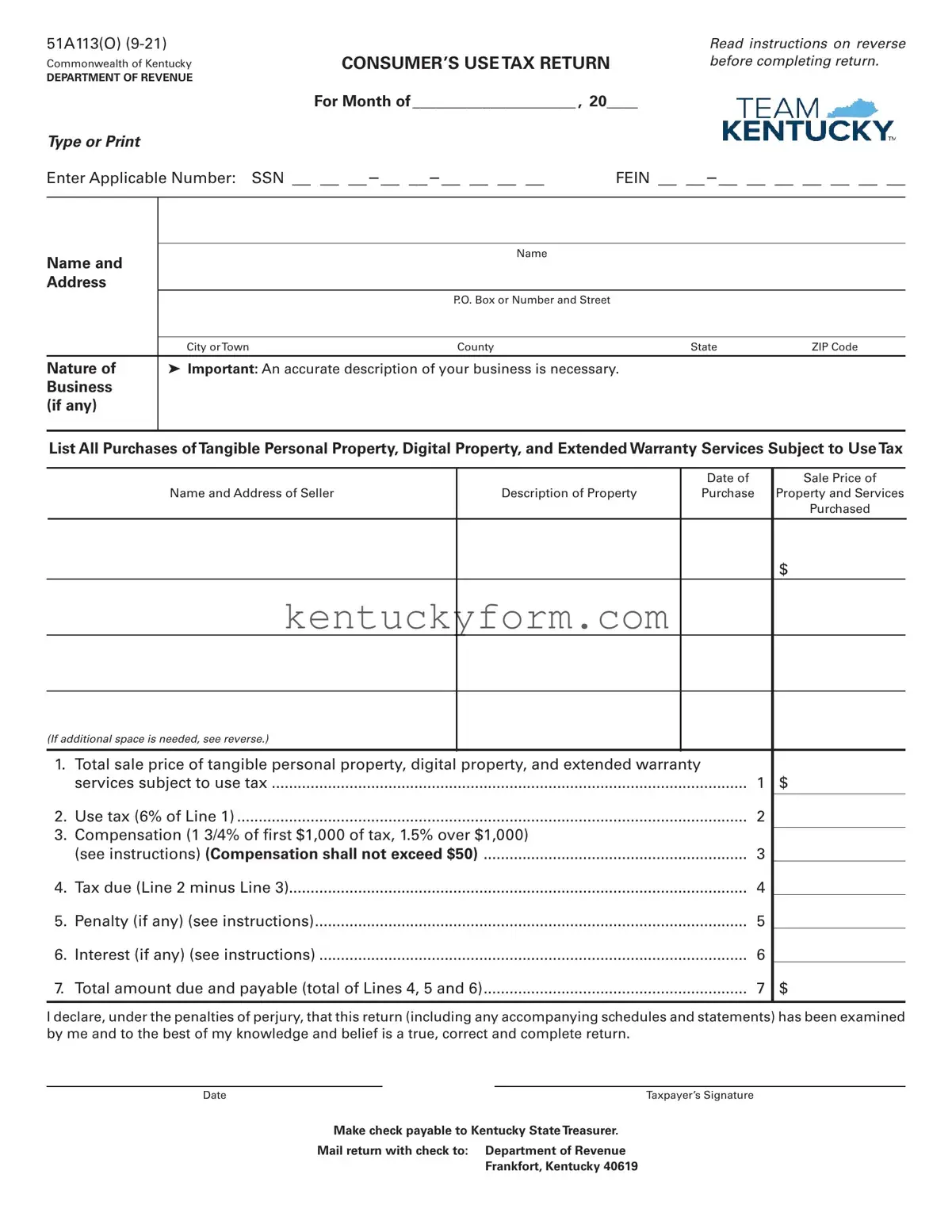

NOTICE

This form is to be filed only by persons or firms liable for use tax who are not: (1) registered consumers or (2) registered retailers. Registered consumers and retailers must use returns mailed to them by the Department, or filed electronically.

INSTRUCTIONS

Time and Place for Filing—A consumer’s use tax return is due 20 days following the month in which a purchase of tangible personal property, digital property, and extended warranty services is made upon which Kentucky sales or use tax has not been paid. The return together with remittance for the total amount due shall be mailed to the Department of Revenue, Frankfort, Kentucky 40619. Remittance should be made payable to the Kentucky State Treasurer.

Tax Rate—The use tax rate is 6 percent of the sales price of all tangible personal property, digital property, and extended warranty services purchased during the month without payment of sales tax.

Sale Price—This means the cost of the tangible personal property, digital property, and extended warranty services to the purchaser less any cash discount received, valued in money or otherwise.

Tangible Personal Property, Digital Property, and Extended Warranty Services—Tangible Personal Property means personal property that is tangible and movable such as mobile homes, campers, airplanes, lumber, clothing, tools, machines, furniture and all other types of goods and merchandise. Digital property means any of the following which is transferred electronically: digital audio works, digital books, finished artwork, digital photographs, periodicals, newspapers, magazines, video greeting cards, audio greeting cards, video games, electronic games and any digital code related to this property. Extended warranty services means services provided through a service contract agreement between the contract provider and the purchaser where the purchaser agrees to pay compensation for the contract and the provider agrees to repair, replace, support, or maintain tangible personal property or digital property according to the terms of the contract. Extended warranty services are only subject to use tax provided the service agreement is sold or extended after July 1, 2018, and the tangible personal property or digital property for which the service agreement is purchased is subject to tax under KRS 139 or KRS 138.460.

Completing the Return—List in the space provided all purchases of tangible personal property, digital property, and extended warranty services subject to use tax, and enter the total on Line 1. All tangible personal property, digital property, and extended warranty services purchased for storage, use or consumption without payment of Kentucky sales and use tax should be listed and included on Line 1.

Penalties and Interest—The penalty for failure to file a return by the due date is 2 percent of the tax for each 30 days or fraction thereof. The total late filing penalty shall not exceed 20 percent of the tax except when the percentage penalty would be less than $10. In such case the penalty shall be $10. Interest will apply to any late payments as provided by KRS 131.183. To calculate the interest, divide the annual interest percentage for underpayments (for 2018 6%) by 365 days and multiply the result by the number of days late times the tax amount. (Example: for 2021, .05/365 X “#” of days late X “$” tax amount.)

The penalty for failure to pay the tax within the time prescribed is 2 percent of the tax not timely paid for each 30 days payment is late—a minimum of $10 is imposed.

Compensation—Compensation is not allowable on any tax not paid on or before the due date. (Compensation shall not exceed $50.)

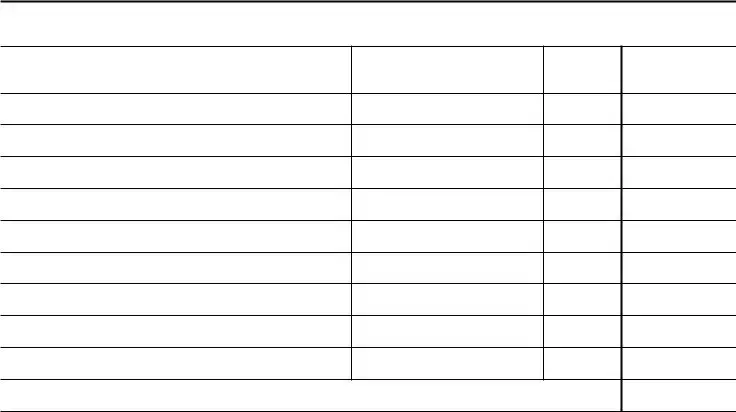

Additional Space for Listing Tangible Personal Property, Digital Property, and

Extended Warranty Services Subject to Use Tax