The Form 1120S, U.S. Income Tax Return for an S Corporation, is quite similar to Kentucky's Form 720S as they both cater to S corporations, albeit at different levels of government. Form 1120S is used by S corporations to report their income, gains, losses, deductions, credits, and other financial information to the federal government. Like the 720S, it also includes schedules for reporting shareholder's proportionate shares of the corporation's income and losses, ensuring that the income is only taxed at the individual shareholders' level, not at the corporate level.

Another form with a notable resemblance to Form 720S is the Form 1065, U.S. Return of Partnership Income. Although Form 1065 is designed for partnerships and not S corporations, it serves a parallel purpose by reporting a partnership's financial information. This includes income, deductions, gains, and losses. Its schedules are used to report each partner's share of the partnership's income or loss, similar to how Form 720S includes schedules for shareholders' shares of income and deductions.

The Kentucky Form 741, Kentucky Fiduciary Income Tax Return, also shares similarities with Form 720S, particularly in its function of allocating income to beneficiaries or shareholders. While Form 741 is specifically for estates and trusts detailing income, deductions, and credits, it parallels the 720S in its role of ensuring income is taxed at the beneficiary level, following the principle of pass-through taxation similar to that applied in S corporations.

Form 940, Employer's Annual Federal Unemployment (FUTA) Tax Return, though primarily focusing on unemployment tax, shares a commonality with Form 720S in its requirement for employer identification numbers (EIN) and the reporting of business activity within a specific period. Both forms necessitate detailed business operation information, even though for different aspects of tax.

The Schedule K-1 (Form 1065), Partner's Share of Income, Deductions, Credits, etc., is directly analogous to parts of the Kentucky Form 720S that deal with allocating the S corporation's income and deductions to its shareholders. The Schedule K-1 serves to report each partner's share of a partnership's income, deductions, and credits, mirroring the 720S's role in distributing the S corporation's financial activities among its shareholders.

Form 990, Return of Organization Exempt From Income Tax, while primarily for tax-exempt organizations, aligns with the 720S in its structure of reporting income, expenses, and contributions. Both are comprehensive, requiring detailed financial disclosures and adherence to specific tax codes. Form 990 ensures transparency and accountability for nonprofit organizations, similarly to how the 720S regulates S corporations' financial reporting.

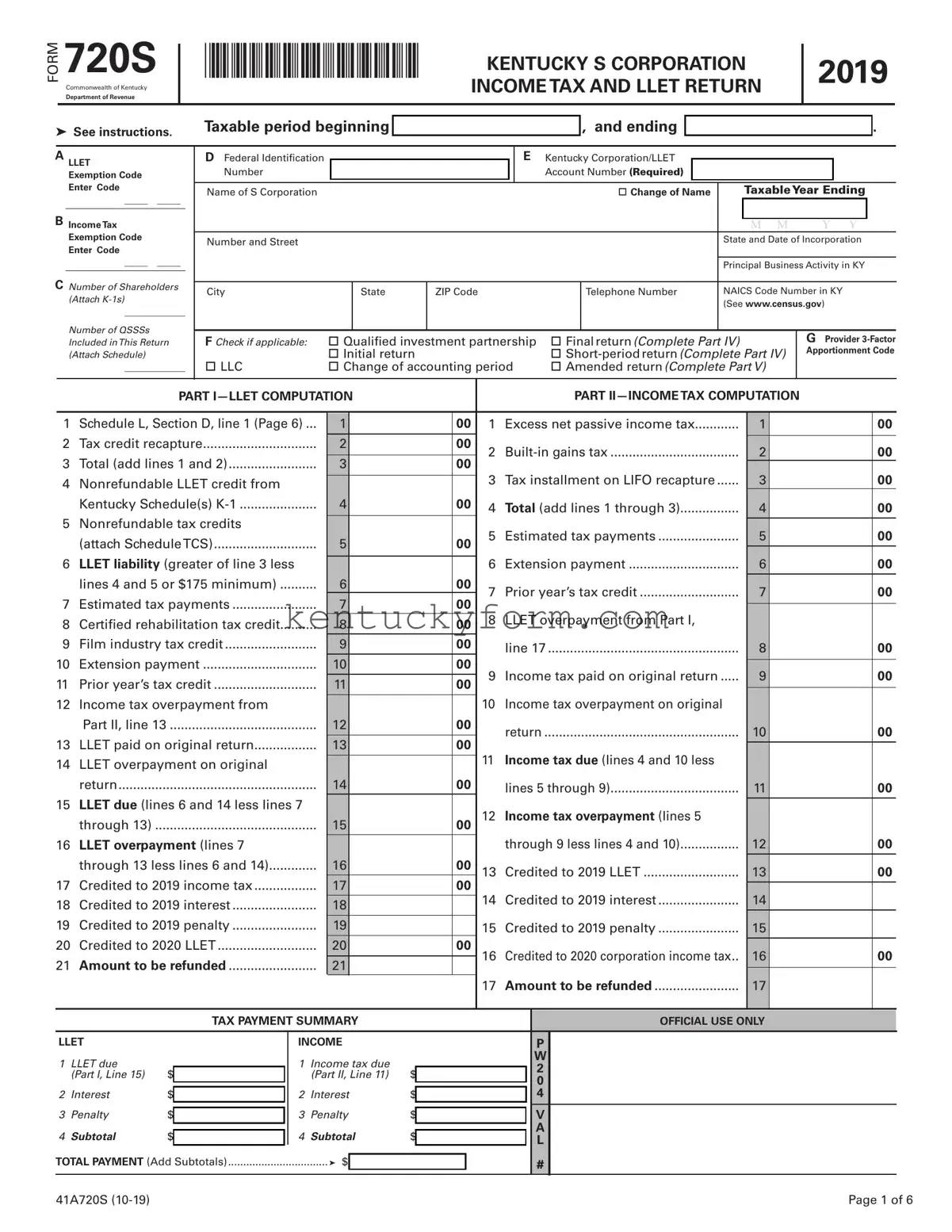

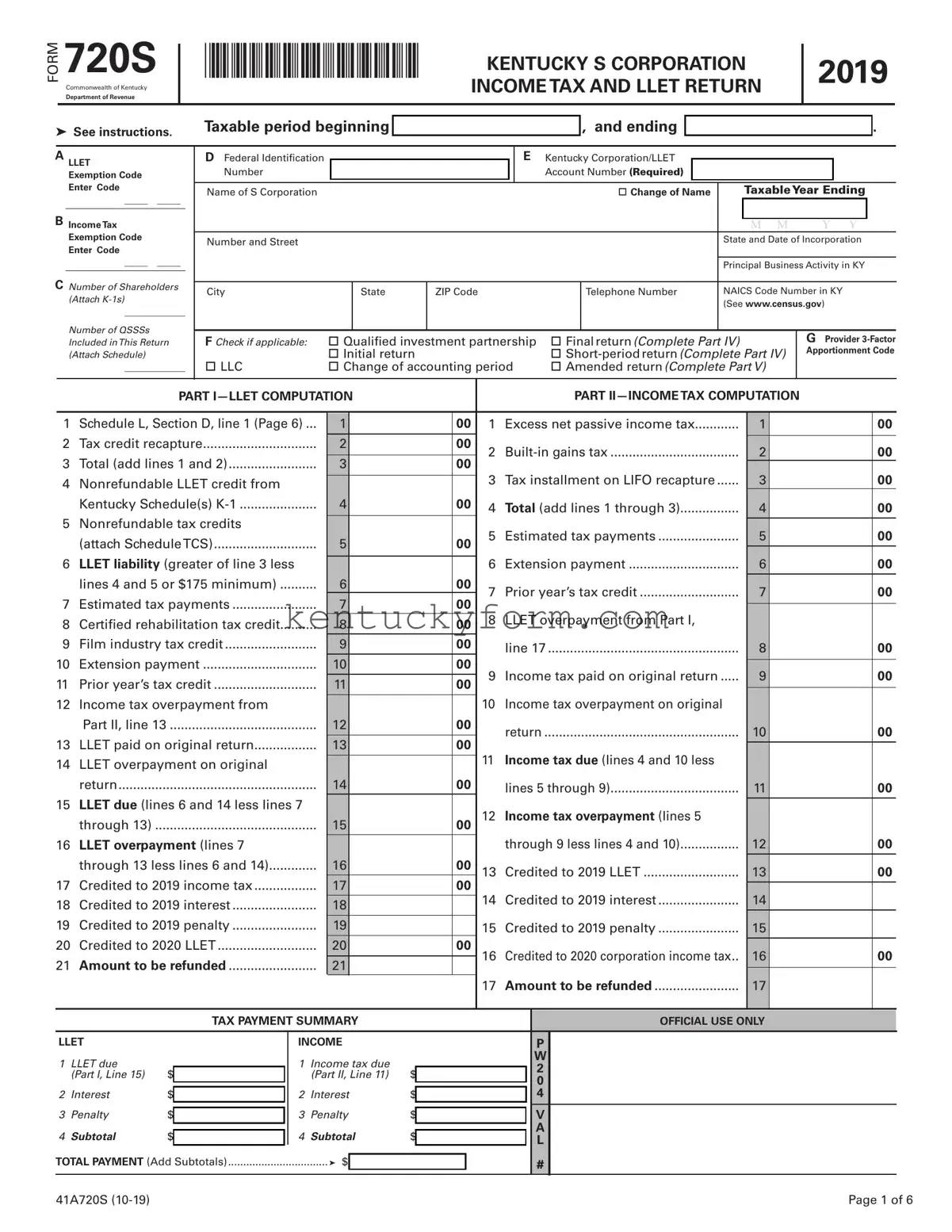

The Kentucky Form LLET (Limited Liability Entity Tax), which is actually a component of the Form 720S, but can stand as a distinct requirement for certain business entities. It focuses on the minimum business tax obligation in Kentucky, emphasizing the entity's gross receipts or profits, paralleling the broader income and tax liability reporting on the 720S.

Form 8825, Rental Real Estate Income and Expenses of a Partnership or an S Corporation, is closely similar to sections of the 720S that focus on income or losses from rental real estate. This form is used by partnerships and S corporations to report income and deductible expenses from rental properties, reflecting a specific aspect of the broader financial reporting covered in the 720S.

Form CT-3, the New York State Corporation Franchise Tax Return, is akin to the Kentucky Form 720S as both are state-level corporate income tax returns. The CT-3 serves the same primary purpose for New York-based corporations, including S corporations, requiring detailed financial data to calculate tax liability, similar to the Kentucky form's requirements for S corporations operating within Kentucky.

Finally, the Form 2553, Election by a Small Business Corporation, shares a preparatory kinship with the 720S. While not a tax return, it is used by corporations to elect S corporation status under the Internal Revenue Code. This election directly influences the relevance and necessity of filing the 720S for Kentucky-based entities, establishing the foundation for the pass-through taxation mechanism that underlies the 720S's reporting structure.