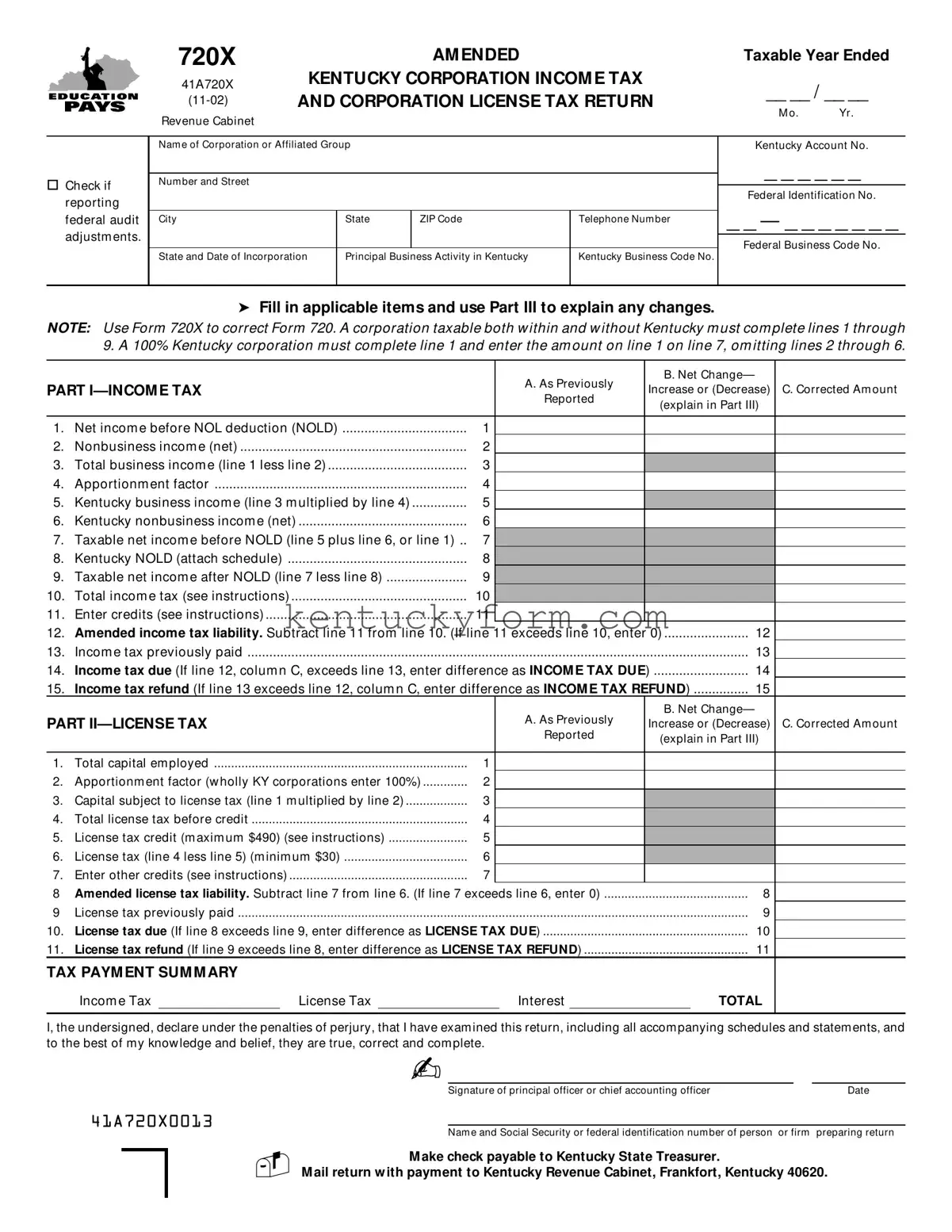

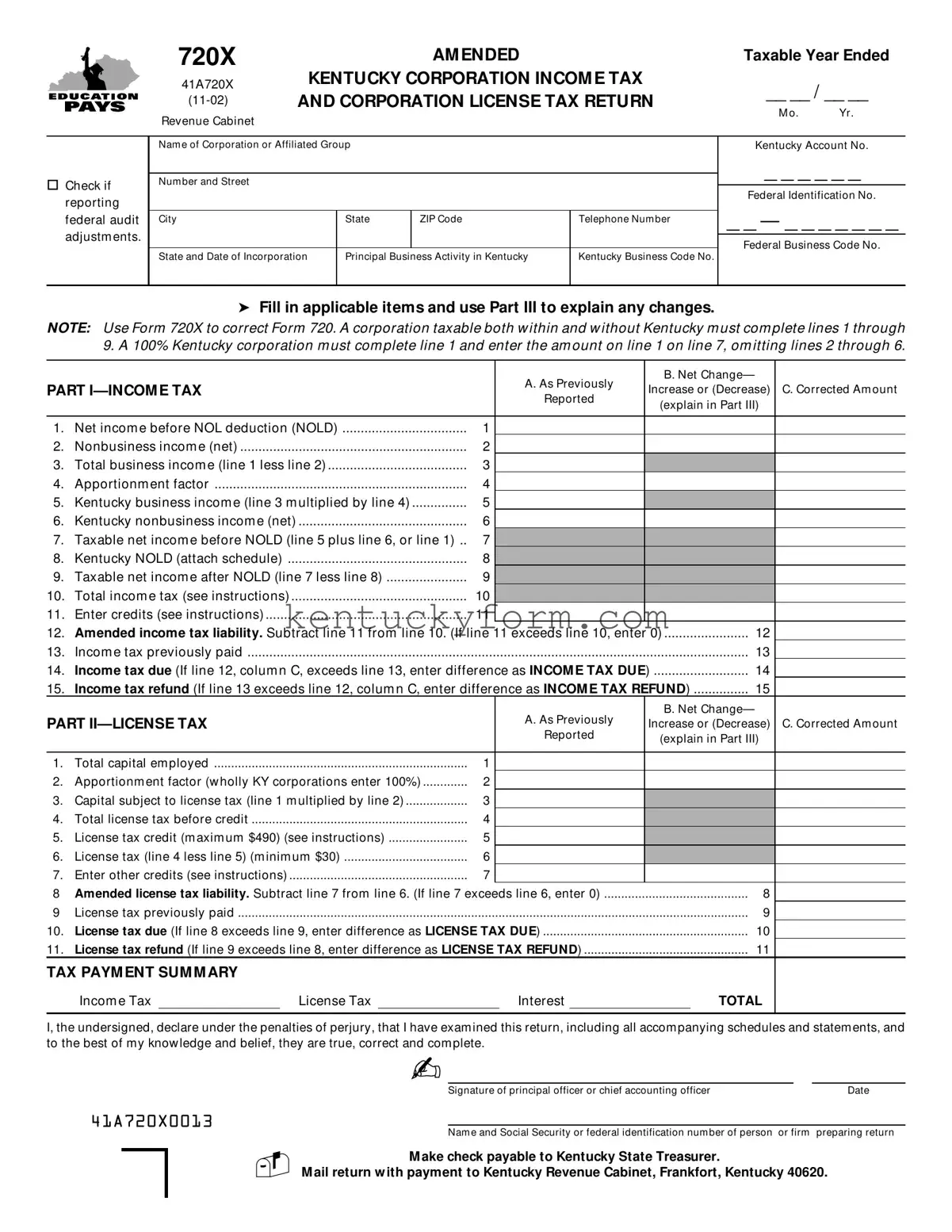

GENERAL INSTRUCTIONS

Purpose of Form—Use Form 720X to report changes, including federal audit changes, to Form 720, Kentucky Corporation Incom e and License Tax Return, as previously reported.

Information on Income, Deductions, Tax Computation, etc.—Refer to the instructions for Form 720, Kentucky Corporation Incom e and License Tax Return, related schedules and form s, for the year being am ended to determ ine the taxability of certain types of incom e, the allow ability of certain expenses as deductions from incom e, com putation of tax, etc.

Where to File—M ail this form to Kentucky Revenue Cabinet, Frankfort, Kentucky 40620.

SPECIFIC INSTRUCTIONS

PART I—INCOM E TAX

Line 1, Column A—Enter the am ount previously reported.

Column B—Enter the increase or decrease being m ade. Explain the increase or decrease in Part III. If the change involves an item of incom e or deduction that is supported by a schedule, statem ent or form , attach the appropriate schedule, statem ent or form . If the change involves a federal audit adjustm ent, attach the "final determ ination of the federal audit." Do not include changes to net operating loss deduction here (see line 8 instructions below ).

Column C—Enter the result of adding the increase in colum n B to the am ount in colum n A or subtracting the colum n B decrease from colum n A. If there is no change entered in colum n B, enter the am ount from colum n A.

Lines 2 Through 6

Note: These lines are applicable only to corporations taxable both w ithin and w ithout Kentucky. Corporations taxable only in Kentucky om it these lines and enter am ount from line 1 on line 7.

Column A—On each line, 2 through 6, enter am ount from appropriate line of Schedule A, Form 720 as previously reported.

Column B—On lines 2, 4 and 6, enter any increases or decreases being m ade, explain in Part III and attach a corrected Schedule A, Form 720.

Column C—On lines 2, 4 and 6, enter the result of adding the increase in colum n B to the am ount in colum n A or subtracting the colum n B decrease from colum n A. If there is no change entered in colum n B, enter the am ount from colum n A.

Line 8, Column C—Enter the am ount of net operating loss deduction (NOLD). The am ount of NOL to be carried back or forw ard for Kentucky incom e tax purposes is the am ount of loss determ ined on the Kentucky return; in the case of a corporation taxable both w ithin and w ithout Kentucky, it is the am ount determ ined after apportionm ent and allocation (attach schedule show ing com putation of the am ount claim ed).

Line 10, Column C—Determ ine corrected incom e tax by using tax rates reflected on Tax Com putation Schedule of Form 720 used for filing original return for the year.

41A720X0023

Line 11, Column A—Enter total am ount of credit from appropriate lines of Tax Com putation Schedule or Incom e Tax Com putation of Form 720 as previously reported.

Column B—Enter any increase or decrease being m ade. If an entry is m ade on this line, attach a schedule reflecting com putations (see Tax Com putation Schedule of Form 720 for year originally filed for lim itations). Also attach applicable tax credit schedules or form s.

Column C—Enter the result of adding the increase in colum n B to the am ount in colum n A or subtracting the colum n B decrease from colum n A. If there is no change entered in colum n B, enter am ount from colum n A.

Line 13—Enter total incom e tax previously paid for taxable year less any refund previously received for taxable year.

PART II—LICENSE TAX

A corporation may only amend its license tax return to reflect changes in the apportionment factor or to correct errors or omissions of capital.

Lines 1 and 2—Enter in colum n A the am ount from appropriate line of Form 720, Part III, as previously reported. Enter in colum n B any increases or decreases being m ade and explain in Part III. Enter the result of adding the increase in colum n B to the am ount in colum n A or subtracting the colum n B decrease from colum n A. If there is no change entered in colum n B, enter the am ount from colum n A.

Line 4—Determ ine corrected tax due on am ount reflected on line 3. The tax rate is $2.10 on each $1,000 of capital em ployed or a m inim um of $30.

Line 5—A corporation w ith gross incom e of $500,000 or less is allow ed a credit of $1.40 per thousand of the first $350,000 of capital em ployed against the license tax. For the purpose of this credit, gross incom e m eans total taxable and nontaxable receipts before reduction for cost of goods sold, cost of assets sold or any other deduction.

Line 6—Subtract the am ount on line 5, if applicable, from the am ount on line 4, and enter the result or $30, w hichever is greater.

Line 7, Column A—Enter total am ount of other credits (KIFA tax credit, KIRA tax credit, or coal incentive tax credit) from appropriate lines of the Form 720 as previously reported.

Column B—Enter any increase or decrease being m ade. If an entry is m ade on this line, attach a schedule reflecting com putations. Also, attach applicable tax credit schedules.

Column C—Enter the result of adding the colum n B increase to the am ount in colum n A or subtracting the colum n B decrease from colum n A. If there is no change entered in colum n B, enter am ount from colum n A.

Line 9—Enter total license tax previously paid for the taxable year less any refund previously received for the taxable year.

TAX PAYM ENT SUM M ARY—If am ounts of additional tax due are reflected on either Part I, line 14, or Part II, line 10, enter am ounts due in proper place in this section. Com pute interest from the original due date of the return to the date of paym ent. For years ending prior to July 1, 1982, the rate is 8 percent per annum until paid. For tax years ending after June 30, 1982, variable rates apply to the periods during w hich the tax w as unpaid as follow s: July through Decem ber 1982, 16 percent; calendar 1983, 13 percent; calendar 1984, 11 percent; calendar 1985, 13 percent; calendar 1986, 10 percent; calendar 1987, 8 percent; calendar 1988, 9 percent; calendar 1989, 10 percent; calendar 1990, 11 percent; calendar 1991, 10 percent; calendar 1992, 8 percent; calendar 1993, 7 percent; calendar 1994, 7 percent; calendar 1995, 8 percent; calendar 1996, 9 percent; calendar 1997, 8 percent; calendar 1998, 9 percent; calendar 1999, 8 percent; calendar 2000, 8 percent; calendar 2001, 10 percent; calendar 2002, 6 percent; and calendar 2003, 5 percent.