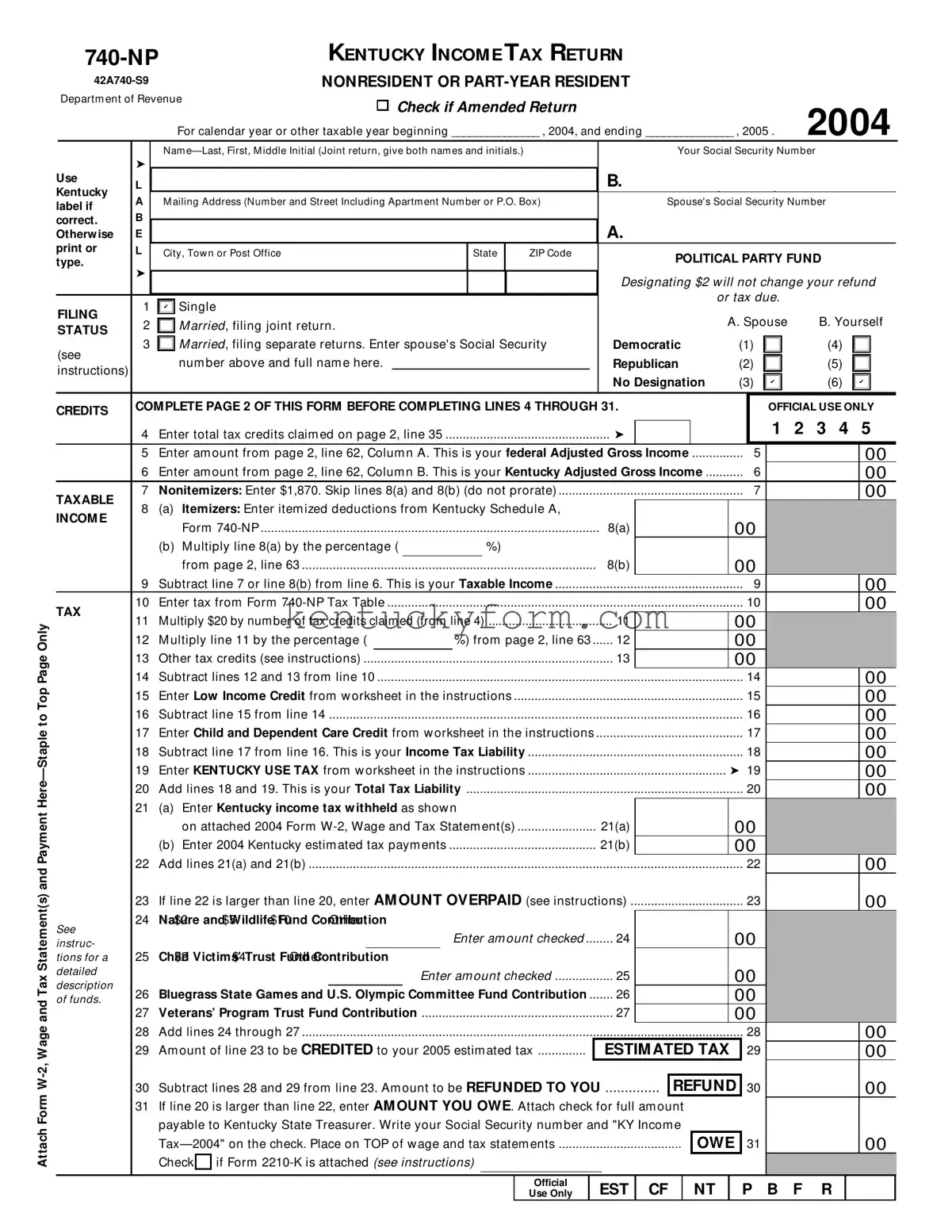

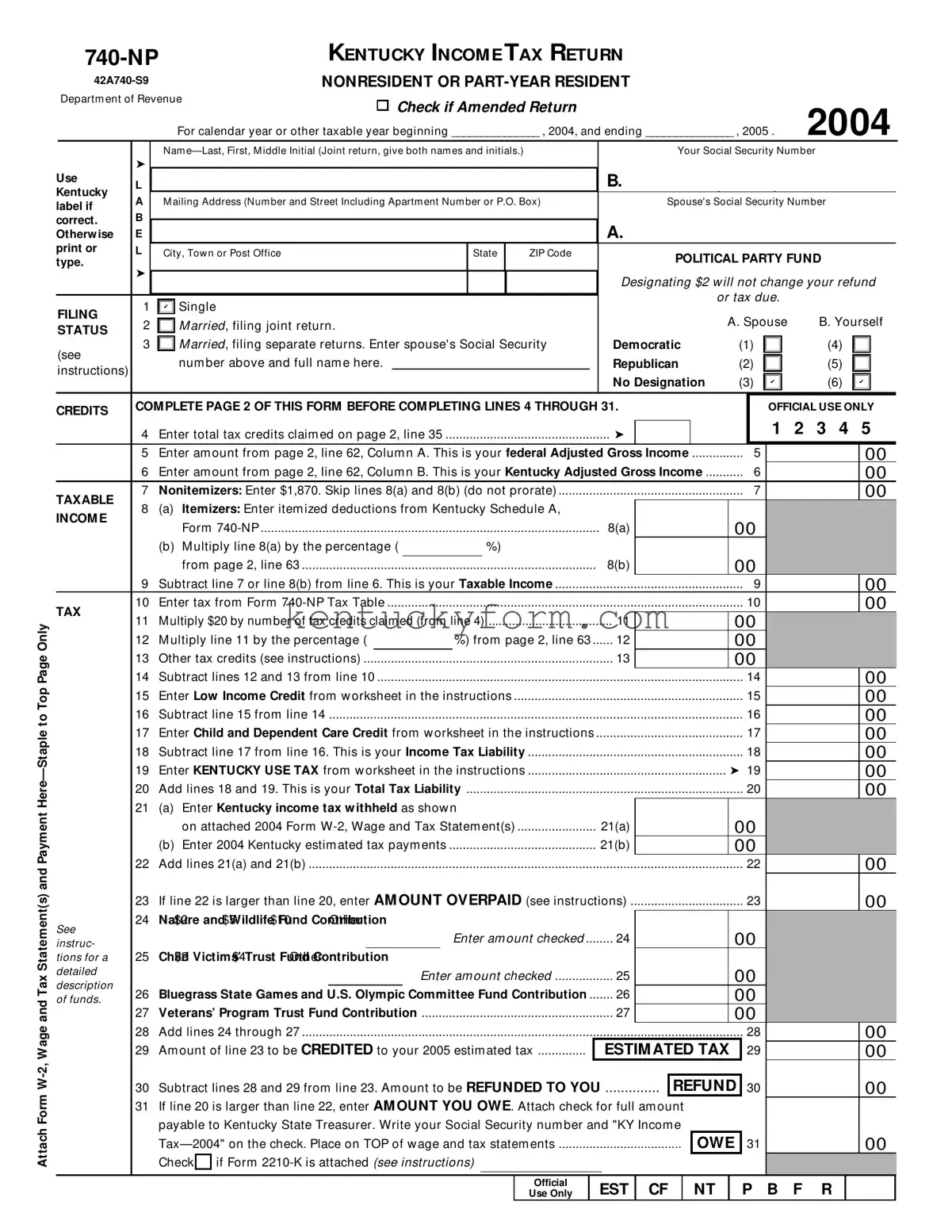

The IRS Form 1040NR, U.S. Nonresident Alien Income Tax Return, shares similarities with the Kentucky 740-NP form as they both are dedicated to individuals who do not reside within the jurisdiction but have earned income from it. These forms calculate the tax liability based on the income earned within the respective territories (United States for the 1040NR and Kentucky for the 740-NP) and include provisions for various deductions and credits to determine the final tax liability.

California Form 540NR, Nonresident or Part-Year Resident Income Tax Return, is also similar to the Kentucky 740-NP form. Like the Kentucky form, this document is used by individuals who either lived in California for only part of the year or earned income in the state without being residents. Both forms adjust taxable income based on the portion attributable to the state, allowing nonresidents and part-year residents to file taxes specific to the income earned within the state.

The IRS Schedule C (Profit or Loss from Business) is used to report income or loss from a business operated or a profession practiced as a sole proprietor. While the Kentucky 740-NP form itself is not specifically for businesses, it requires information from federal schedules, including income or loss reported on Schedule C, to accurately report and tax income derived from Kentucky sources.

The IRS Form 2106 (Employee Business Expenses) is required for individuals to itemize work-related expenses that are not reimbursed by their employer. The relevance to the Kentucky 740-NP form comes into play as certain adjustments to income on the federal level, including those documented on Form 2106, impact the Adjusted Gross Income (AGI) reported on state tax forms including the 740-NP, affecting the taxable income calculation for the state.

Form W-2, Wage and Tax Statement, directly ties to both federal and state tax forms like the Kentucky 740-NP. This document details an employee's income and withheld taxes for the year. For the 740-NP, the Form W-2 provides essential information regarding income earned and taxes already paid, crucial for calculating the taxpayer's liability or refund due from Kentucky.

The IRS Schedule SE (Self-Employment Tax) is another document with a connection to the Kentucky 740-NP form. Self-employed individuals use Schedule SE to calculate the tax due on net earnings from self-employment. While Kentucky's form does not directly calculate self-employment tax, the income and deductions reported on Schedule SE affect the AGI, which is a critical component of the Kentucky 740-NP.

IRS Form 2210 (Underpayment of Estimated Tax by Individuals, Estates, and TrusteS) relates to Kentucky 740-NP through the calculation and reporting of estimated tax payments. Taxpayers who do not have sufficient income tax withheld throughout the year may need to make estimated tax payments to avoid underpayment penalties. The 740-NP addresses this scenario through its section for reporting estimated payments made to Kentucky.

The IRS Form 1099 series, which documents various types of income other than wages, salaries, and tips, impacts the reporting on Kentucky 740-NP similarly. Information from 1099 forms, such as dividends, interest, and miscellaneous income, must be reported on the 740-NP if this income is attributable to sources within Kentucky, affecting the state income tax calculation.

IRS Form 4868 (Application for Automatic Extension of Time To File U.S. Individual Income Tax Return) shares a procedural relation with the Kentucky 740-NP form. If a taxpayer files Form 4868 for a federal extension, they typically need to do so for the state return as well. The 740-NP instructions include guidelines for taxpayers who have obtained a federal extension, indicating how to handle filing deadlines for the Kentucky return.

Finally, the IRS Schedule A (Itemized Deductions) is closely related to parts of the Kentucky 740-NP form. Taxpayers who itemize deductions on the federal level with Schedule A can often deduct some of those expenses on their state return as well. The 740-NP form considers these federal itemizations in adjusting state taxable income, especially with deductions that are also recognized by Kentucky tax law.