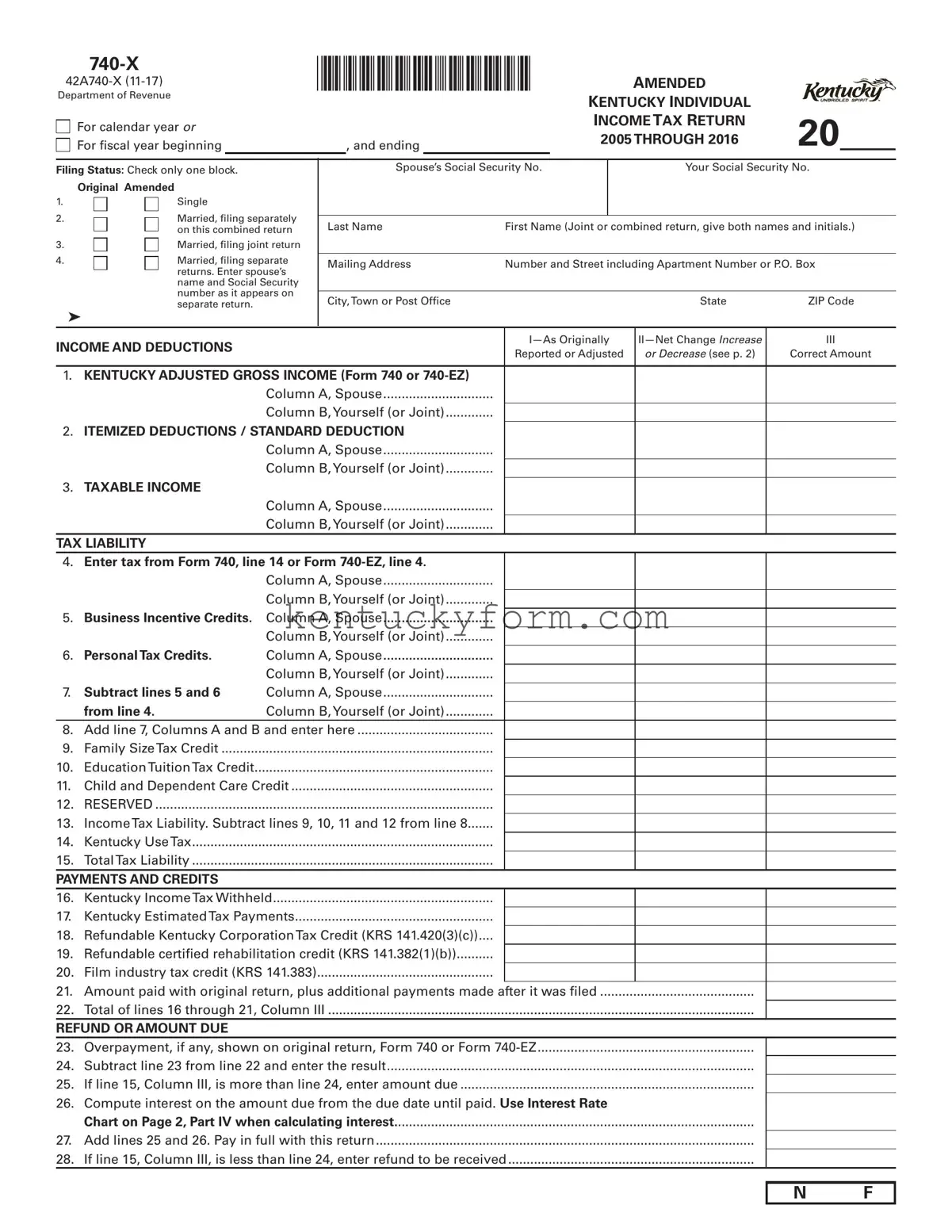

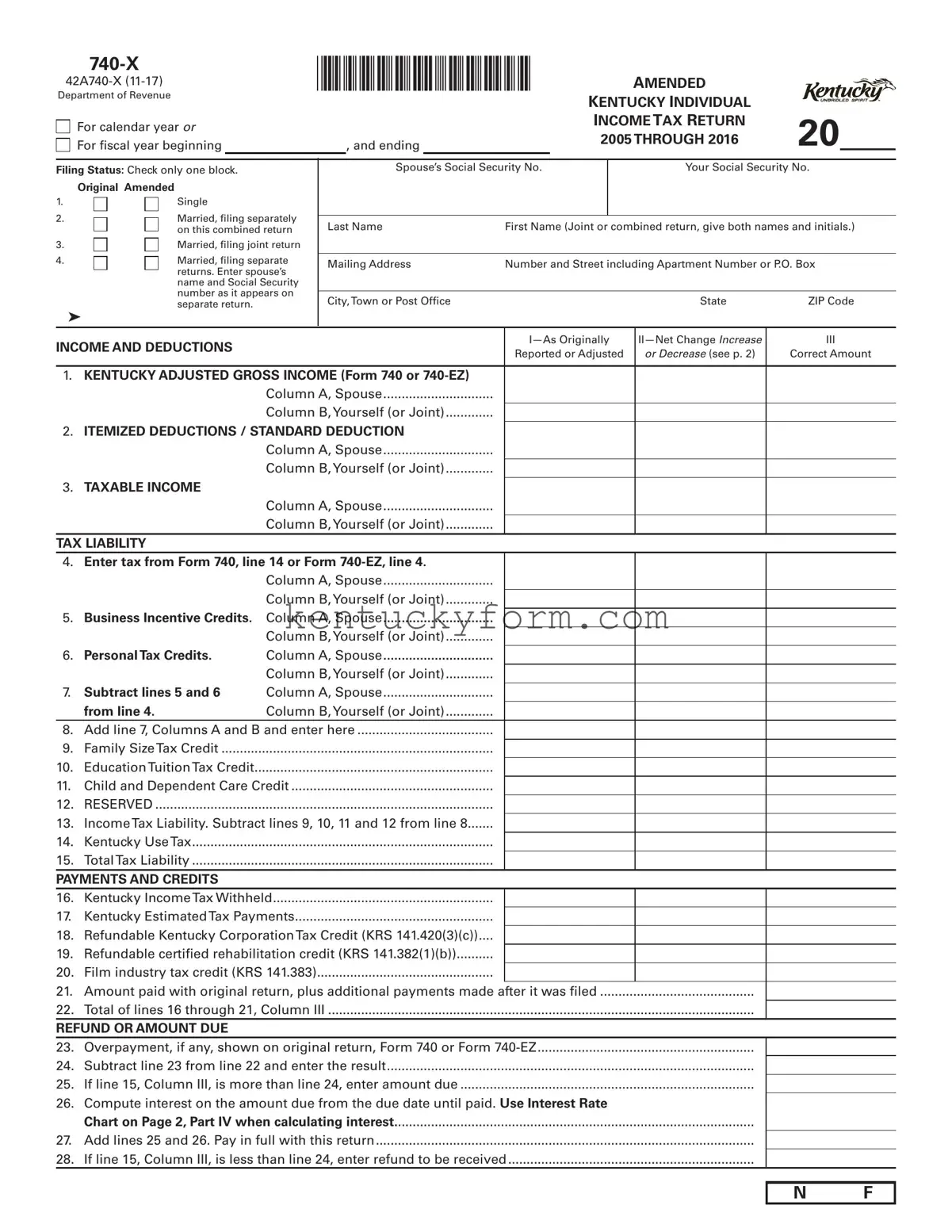

The Kentucky 740-X form, designed for amending individual income tax returns, shares similarities with numerous other documents aimed at correcting or updating previously submitted tax information. Understanding these documents can provide a comprehensive view into the tax amendment processes across different jurisdictions and tax considerations. Each of these documents serves a specific purpose, making them essential tools for taxpayers seeking to rectify their records with tax authorities.

The IRS Form 1040-X, "Amended U.S. Individual Income Tax Return," performs a role at the federal level akin to that of the Kentucky 740-X form. Taxpayers use the 1040-X form to correct errors on previously filed Form 1040, 1040-A, and 1040-EZ. This includes changes to filing status, income, deductions, or credits. The structure of Form 1040-X, which separates original figures from amended ones in a columnar format, makes it easy for the IRS to understand the nature and reason for each amendment, mirroring the organizational approach of the Kentucky 740-X.

The California Form 540-X, "Amended Individual Income Tax Return," serves taxpayers who need to make amendments to their California state income tax returns. Similar to the Kentucky 740-X, the California 540-X allows for changes in income, deductions, tax credits, and personal information, reflecting a common need across states for a structured process to correct prior returns. While jurisdictional specifics and state-level tax laws differ, the overarching purpose and the general process of these forms are comparable.

New York’s Form IT-201-X, "Amended Resident Income Tax Return," offers a similar avenue for residents to rectify their state tax returns. This form is used when adjustments are necessary, be it for reporting additional income, changing the amount of deductions, or correcting tax credit amounts. The process underscores the universal need among taxpayers to amend returns while adhering to state-specific tax structures and regulations, much like Kentucky's approach with the 740-X form.

The Illinois Form IL-1040-X, "Amended Individual Income Tax Return," is another state-level document allowing taxpayers to update or correct previously filed state income tax returns. This form is important for ensuring that taxpayers in Illinois can amend their filing status, income, and credits or deductions accurately. This process, parallel to that in Kentucky, emphasizes the states' roles in managing their tax collection efficiently while providing mechanisms for taxpayers to correct errors.

The Ohio IT 1040X, "Ohio Amended Individual Income Tax Return," enables Ohio residents to submit corrections to previously filed IT 1040 forms. This document facilitates the adjustment of income figures, credits, deductions, and Ohio’s school district taxes if applicable. Similar to the Kentucky 740-X, the Ohio form underscores the importance of such documents in maintaining accurate and fair tax records at the state level.

Pennsylvania’s Schedule PA-40X, "Amended PA Personal Income Tax Schedule," is used alongside the PA-40 tax return form to report changes or corrections from the original submission. This method of amending a return is in line with Kentucky’s approach, allowing for adjustments in income, expenses, and credits, reflecting a nationwide standard for tax corrections and updates.

The Michigan Form MI-1040X, "Amended Income Tax Return," provides Michigan taxpayers with a means to correct their state tax returns. The form addresses changes in income, tax credits, deductions, and tax liability or refund amounts. This demonstrates the adaptability of state tax systems to accommodate revisions, ensuring that taxpayers have the necessary tools to correct their filings, similar to practices in Kentucky.

The Colorado Form 104X, "Amended Colorado Income Tax Return," allows residents to make amendments to their state income tax returns. This form is utilized for various adjustments, including correcting income, tax calculation errors, or the amount of Colorado tax credits claimed. It exemplifies the commonality of the need for tax amendment forms across states, ensuring taxpayers have a clear path to rectify their tax records.