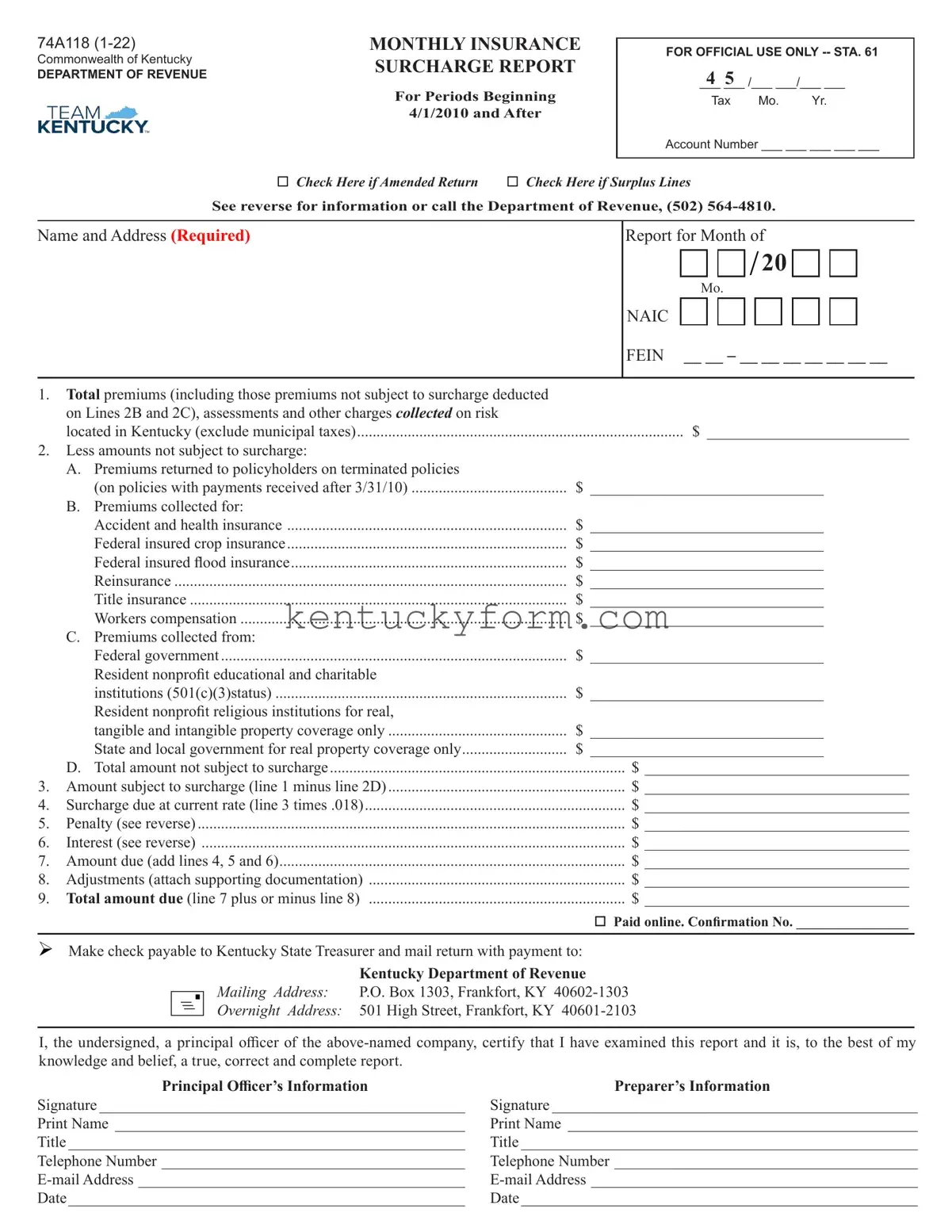

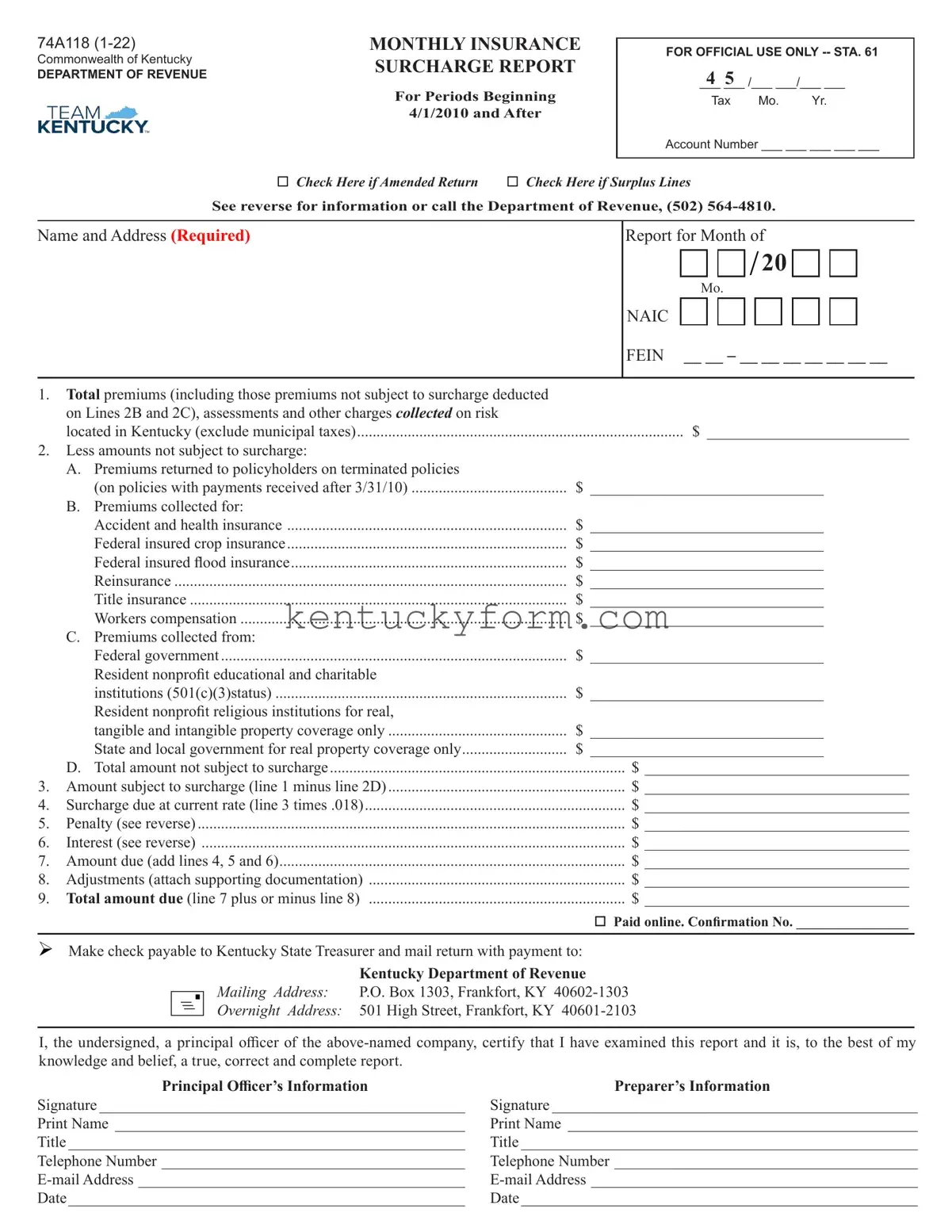

74A118 (1-22) |

MONTHLY INSURANCE |

Commonwealth of Kentucky |

SURCHARGE REPORT |

DEPARTMENT OF REVENUE |

|

For Periods Beginning |

|

4/1/2010 and After |

FOR OFFICIAL USE ONLY -- STA. 61

___4 ___5 /___ ___/___ ___

Tax Mo. Yr.

Account Number ___ ___ ___ ___ ___

Check Here if Amended Return |

Check Here if Surplus Lines |

See reverse for information or call the Department of Revenue, (502) 564-4810.

Name and Address (Required)

Report for Month of

/ 20

Mo.

NAIC

FEIN __ __ – __ __ __ __ __ __ __

1.Total premiums (including those premiums not subject to surcharge deducted on Lines 2B and 2C), assessments and other charges collected on risk

located in Kentucky (exclude municipal taxes) |

$ __________________________ |

2.Less amounts not subject to surcharge:

A. Premiums returned to policyholders on terminated policies

|

(on policies with payments received after 3/31/10) |

$ |

______________________________ |

B. |

Premiums collected for: |

|

|

|

Accident and health insurance |

$ |

______________________________ |

|

Federal insured crop insurance |

$ |

______________________________ |

|

Federal insured flood insurance |

$ |

______________________________ |

|

Reinsurance |

$ |

______________________________ |

|

Title insurance |

$ |

______________________________ |

|

Workers compensation |

$ |

______________________________ |

C. |

Premiums collected from: |

|

|

|

Federal government |

$ |

______________________________ |

|

Resident nonprofit educational and charitable |

|

|

|

institutions (501(c)(3)status) |

$ |

______________________________ |

|

Resident nonprofit religious institutions for real, |

|

|

|

tangible and intangible property coverage only |

$ |

______________________________ |

|

State and local government for real property coverage only |

$ |

______________________________ |

|

D. Total amount not subject to surcharge |

$ __________________________________ |

3. |

Amount subject to surcharge (line 1 minus line 2D) |

$ __________________________________ |

4. |

Surcharge due at current rate (line 3 times .018) |

$ __________________________________ |

5. |

Penalty (see reverse) |

$ __________________________________ |

6. |

Interest (see reverse) |

$ __________________________________ |

7. |

Amount due (add lines 4, 5 and 6) |

$ __________________________________ |

8. |

Adjustments (attach supporting documentation) |

$ __________________________________ |

9. |

Total amount due (line 7 plus or minus line 8) |

$ __________________________________ |

Paid online. Confirmation No. ________________

Make check payable to Kentucky State Treasurer and mail return with payment to:

Kentucky Department of Revenue

Mailing Address: P.O. Box 1303, Frankfort, KY 40602-1303

Overnight Address: 501 High Street, Frankfort, KY 40601-2103

I, the undersigned, a principal officer of the above-named company, certify that I have examined this report and it is, to the best of my knowledge and belief, a true, correct and complete report.

Principal Officer’s Information |

Preparer’s Information |

Signature _______________________________________________ |

Signature _______________________________________________ |

Print Name _____________________________________________ |

Print Name _____________________________________________ |

Title ___________________________________________________ |

Title ___________________________________________________ |

Telephone Number _______________________________________ |

Telephone Number _______________________________________ |

E-mail Address __________________________________________ |

E-mail Address __________________________________________ |

Date___________________________________________________ |

Date___________________________________________________ |

GENERAL INFORMATION

KRS 136.392 requires that every domestic, foreign and alien insurer, other than life and health insurers, which is subject to or exempted from Kentucky insurance premiums taxes as levied pursuant to the provisions of either KRS 136.350, 136.370 or 136.390, shall charge and collect a surcharge at the current rate upon each $100 of premium, assessments or other charges, except for whether the charges are designated as premiums, assessments or otherwise.

Every insurer is required to file for each period, whether filing monthly or annually, even if no premiums were collected.

The insurance premium surcharge shall be collected by the insurer from its policyholders at the same time and in the same manner that its premium or other charge for the insurance coverage is collected. When claiming a deduction for premiums returned to a policyholder, the surcharge must also be returned to the policyholder.

No insurer or its agent shall be entitled to any portion of any premium surcharge as a fee or commission for its collection.

On or before the 20th day of each month, each insurer shall report and remit to the Department of Revenue, on the required forms, all premium surcharge monies collected during the preceding monthly accounting period less any monies returned to policyholders on policies terminated by either the insured or the insurer. Insurers with an annual liability of less than $1,000 for each of the previous two calendar years may report and remit to the Department of Revenue all premium surcharge monies collected on a calendar year basis on or before the 20th day of January of the following year.

Account Number For Surplus Lines

•Multi-Brokers—File under agency name and their FEIN number.

•Single Broker—File under agency name and their FEIN number. If no FEIN number, use your Department of Insurance (DOI) number.

The penalty for failure to file an insurance premium surcharge report by the due date is 2 percent of the surcharge due for each 30 days or fraction thereof that the report is late (maximum 20 percent). The minimum penalty is $10. (KRS 131.180 (1))

The penalty for failure to pay the insurance premium surcharge by the due date is 2 percent of the surcharge due for each 30 days or fraction thereof that the payment is overdue (maximum 20 percent). The minimum penalty is $10. (KRS 131.180 (2))

Interest at the “tax increase rate” is applied to all insurance premium surcharge liabilities not paid by the original due date of the report. The computation period is from the original due date of the report to the date of payment. (KRS 131.183 (1))

Report on line 1 only those premiums that have been collected.

NOTE: Refunds or credits can only be taken on premiums returned to policy holders on terminated policies, not on exempt premiums such as worker’s compensation insurance. Refund requests must be made in writing.

Types of Policyholders Exempt or Partially Exempt from the Insurance Premium Surcharge pursuant to KRS 136.392(5):

•The federal government;

•Resident educational and charitable institutions qualifying under Section 501(c)(3) of the Internal Revenue Code;

•Resident nonprofit religious institutions for real, tangible, and intangible property coverage only;

•State government for coverage of real property; or

•Local governments for coverage of real property.

Also, Exempt from the Insurance Premium Surcharge:

•Premiums received by life and health insurers pursuant to KRS 136.392(1);

•Municipal premium taxes pursuant to KRS 136.392(1);

•Premiums received for accident and health insurance;

•Premiums received for federal insured crop insurance;

•Premiums received for federal insured flood insurance;

•Premiums received for reinsurance;

•Premiums received for title insurance; or

•Premiums received for workers’ compensation insurance.

Premiums collected for surety and bonds on public works projects are subject to the surcharge if the contractor is the policyholder. The fact that a governmental entity may be the obligee has no bearing on the application of the surcharge.