Kentucky

Inheritance and Estate Tax

Forms and Instructions

COMMONWEALTH OF KENTUCKY

DEPARTMENT OF REVENUE

For Dates of Death on or After January 1, 2005

(Revised February, 2018)

Kentucky Department of Revenue

Mission Statement

As part of the Finance and Administration Cabinet, the mission of the Kentucky Department of Revenue is to administer tax laws, collect revenue, and provide services in a fair, courteous, and efficient manner for the benefit of the Commonwealth and its citizens.

* * * * * * * * * * * * *

The Kentucky Department of Revenue does not discriminate on the basis of race, color, national origin, sex, age, religion, disability, sexual orientation, gender identity, veteran status, genetic information or ancestry in employment or the provision of services.

NOTICE

If all taxable assets pass to exempt beneficiaries and a Federal Estate and Gift Tax Return is not required, it is not necessary to file an InheritanceTax Return with the Kentucky Department of Revenue. An affidavit of exemption will be accepted for the final settlement and closing of the administration of an estate. If inheritance tax is due the Commonwealth of Kentucky, Form 92A200 or 92A205 should be used.

The affidavit of exemption is to be filed only with the court. Do not send a copy of the affidavit to the Kentucky Department of Revenue.

Sample Affidavit of Exemption

AFFIDAVIT OF EXEMPTION

Affiant ____________________________ , being first duly sworn, states that he/she is fiduciary or beneficiary of the

estate of _______________________________ , who died on the _______ day of __________________ , _______ , a resident

of _________________________ County, Kentucky.

Affiant states that all assets of the estate pass to exempt beneficiaries pursuant to Kentucky Revised Statute 140.080* or exempt organizations pursuant to Kentucky Revised Statute 140.060** either by virtue of the decedent’s will, the intestate laws of this state, or by contract (survivorship, payable on death, trust, etc.).

Affiant further states that a Kentucky Inheritance Tax Return will not be filed since no death tax is due the state and a Federal Estate and Gift Tax Return (Form 706) is not required to be filed because the gross estate is less than the required amount set out in Section 2010(c) of the Internal Revenue Code. This affidavit is being submitted to satisfy the requirements of Kentucky Revised Statute 395.605.

__________________________________________________________

Signature

Witness my hand this ________ day of __________________________ , __________ .

Sworn and subscribed to before me by _____________________________________

this _______ day of ____________________________________________ , __________ .

______________________________________________________ Notary Public

My commission expires______________________________________

*Exempt beneficiaries under KRS 140.080 include spouse, children, stepchildren, grandchildren, parent, brother, and sister.

**Exempt organizations include educational, religious or other institutions, societies, or associations, whose sole purpose is to carry on charitable, educational, or religious work. Also, cities, towns or public institutions in this state qualify as exempt organizations provided that any transfer to such an organization is for public purposes.

WHAT’S INCLUDED

INHERITANCE AND ESTATE TAX FORMS

No Tax Due Return (resident and nonresident) and Instructions (Form 92A201) Inheritance Tax Return (resident and nonresident) (Form 92A200)

Inheritance Tax Return (short form) (resident and nonresident) (Form 92A205) Real Estate Valuation Information Form (Form 92A204)

Election to Qualify Terminable Interest Property and/or Power of Appointment Property (Form 92A936) Election to Defer the Payment of Inheritance Tax Through Installments (Form 92A928)

Affidavit of Exemption (Form 92A300) Inheritance Tax Table for Resident Decedent Inheritance Tax Table for Nonresident Decedent Blanket Consent

GENERAL INFORMATION |

|

Supplemental Documents |

1 |

Payment of Tax |

|

Discount |

1 |

Installment Payments |

1 |

Interest |

1 |

Penalties |

1 |

Property to be Included on the Return |

1 |

Valuation of Property—Fair Cash and Agricultural |

2 |

Deductions |

2 |

Federal Estate Tax |

2 |

Qualified Terminable Interest Property (QTIP) and/or Powers of Appointment (POA) |

2 |

Property Previously Taxed |

2 |

Example of Credit for Previously Taxed Property |

3 |

Distribution |

4 |

Exemptions for Beneficiaries of a Resident Decedent |

4 |

Exemptions for Beneficiaries of a Nonresident Decedent |

5 |

Bequest of Tax |

5 |

Property Set Aside Under KRS 391.030(1)(c) |

5 |

Estate Tax |

5 & 6 |

Value of a Life Estate |

6 |

Amended Return |

7 |

Acceptance Letter |

7 |

Protest and Appeal |

7 |

Helpful Hints |

|

Where to Obtain Assistance |

7 |

Reporting of Intangible Property Tax |

7 |

Fiduciary Return |

7 |

Office of the Taxpayer Ombudsman |

7 |

Website for Forms |

7 |

Definitions |

8 & 9 |

Taxpayer Service Centers Locations and Phone Numbers |

10 |

Kentucky Taxpayers Bill of Rights |

inside back cover |

INHERITANCE AND ESTATE TAX FORMS IN THIS PACKET

The forms in this packet should only be used if the date of death occurred on or after January 1, 2005.The forms may be dupli- cated on a computer and the space allocated for each item may be decreased or increased depending on the amount of space required. The forms may be used for a decedent who was a resident or a nonresident of Kentucky.

If all taxable assets pass to exempt beneficiaries and a Federal Estate and Gift Tax Return is not required, it is not neces- sary to file an Inheritance Tax Return with the Kentucky Department of Revenue (DOR). An Affidavit of Exemption will be accepted for the final settlement and closing of the administration of an estate. If inheritance tax or estate tax is due the Commonwealth of Kentucky, Form 92A200 or 92A205 should be used.

If the date of death occurred prior to January 1, 2005, contact the Financial Tax Section, Department of Revenue, Station 61, 501 High Street, Frankfort, KY 40601-2103, (502) 564-4810, fax (502) 564-2695.

Three forms are included in this booklet. Choose one unless an Affidavit of Exemption is used.

1.No Tax Due Return (Form 92A201)

This return may be used for an estate (Kentucky resident or nonresident) if: (1) there is no Kentucky inheritance tax due, (2) the date of death is on or after January 1, 2005, and (3) the entire estate passes to beneficiaries listed in the following group either by contract (survivorship, payable on death, trust, etc.), the decedents will, or the intestate laws of this state:

(1)Surviving spouse, parent

(2)Child (adult or infant)

child by blood, stepchild, child adopted during infancy, or child adopted during adulthood who was reared by the decedent during infancy

(3) Grandchild

issue of child, stepchild, child adopted during infancy, or of a child adopted during adulthood who was reared by decedent during infancy

(4) Brother, sister (whole or half)

Refer to KRS 140.080 for (1) through (4) above

(5) Exempt organizations—Refer to KRS 140.060

Exempt organizations include educational, religious or other institutions, societies, or associations, whose sole purpose is to carry on charitable, educational, or religious work. Also, cities, towns or public institutions in this state qualify as exempt organizations provided that any transfer to such an organization is for public purposes.

2.Inheritance Tax Return (Form 92A200)

This return must be used for an estate (resident or nonresident) when: (1) the date of death is on or after January 1, 2005, and (2) any assets of the estate pass to taxable beneficiaries or taxable organizations, or when Forms 92A201 and 92A205 do not apply.

Instructions are on the back of each schedule.

3.Inheritance Tax Return (Short Form) (Form 92A205)

This return may be used for an estate (Kentucky resident or nonresident) when : (1) a federal estate tax return is not re- quired to be filed, (2) the assets of the estate consist of 10 items or less, (3) no gifts or transfers where made within three years of death without full consideration, (4) no real or personal property was transferred with a retained life interest, (5) the decedent did not possess any power to appoint any real or personal property or have the use of any qualified terminable interest property, and (6) the decedent had not received any real or personal property from another decedent within five years and paid inheritance tax on the property.

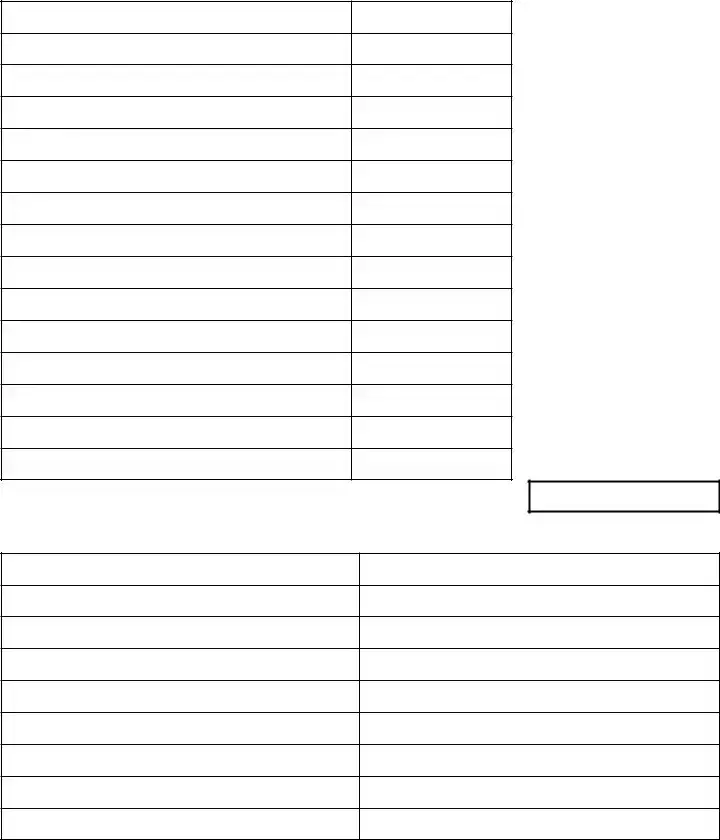

92A201 (6-16)

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

Kentucky Inheritance

Tax Return

NO TAX DUE

FOR DEPARTMENT USE ONLY

|

4 |

6 |

|

|

__ __ __ __ __ __ / __ __ / __ __ / __ __ __ __ |

Account Number |

Tax |

Mo |

Year |

This return may be used if: (1) there is no Kentucky inheritance tax due, (2) the date of death is on or after January 1, 2005, and

(3)the entire estate passes to beneficiaries listed in the following groups either by contract (survivorship, payable on death, trust, etc.), the decedent’s will, or the intestate laws of this state:

(1)Surviving spouse, parent

(2)Child (adult or infant)

child by blood, stepchild, child adopted during infancy,

or a child adopted during adulthood who was reared by decedent during infancy

(3)Grandchild

issue of child by blood, stepchild, child adopted during infancy,

or of a child adopted during adulthood who was reared by decedent during infancy

(4)Brother, sister (whole or half)

Refer to KRS 140.080 for (1) through (4) above

(5)Exempt organizations—Refer to KRS 140.060

Exempt organizations include educational, religious or other institutions, societies, or associations, whose sole purpose is to carry on charitable, educational, or religious work. Also, cities, towns or public institutions in this state qualify as exempt organizations provided that any transfer to such an organization is for public purposes.

Decedent’s Name Last |

First |

Middle Initial |

Date of Death |

|

|

|

|

|

Social Security Number |

Occupation (If decedent was retired |

Age at Death |

Cause of Death |

HR Code Number (if known) |

|

at death, state occupation prior to |

|

|

|

|

retirement.) |

|

|

|

|

|

|

|

|

Residence (Domicile) at Time of Death

|

Number and Street |

City |

State |

ZIP Code |

County |

|

|

|

|

|

|

Name and Address of Executor/Administrator/Beneficiary |

|

Name and Address of Preparer |

|

|

|

|

|

|

|

|

Exec |

|

|

Atty |

|

|

|

Admr |

|

|

CPA |

|

|

|

________ |

|

|

________ |

|

|

|

|

|

|

|

|

|

|

Did the decedent have a will? No Yes If Yes, attach a copy of the will.

Did the decedent have a trust agreement? No |

Yes If Yes, attach a copy of the trust agreement. |

Filing status of Federal Estate and Gift Tax Return for this estate (check one): |

Not Required |

Required (enclose copy) |

Not Required, but filed for Portability (enclose copy) |

Schedules for listing property (real and personal) and beneficiaries are on the reverse side of this form. Listing of property is optional. Listing of beneficiaries and their relationship is required.

Total Value of Property from Reverse Side |

(optional) $ |

|

|

|

|

|

|

Under criminal penalties, I declare that this return, including accompanying documents, has been examined by me, and is, to the best of my knowledge and belief, true, correct and complete.

|

|

|

|

( |

) |

|

|

Signature of Executor/Administrator/Beneficiary |

|

Date |

|

Telephone Number |

|

E-mail Address |

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

Signature of Preparer |

|

Date |

|

Telephone Number |

|

E-mail Address |

Mail to: Kentucky Department of Revenue, Frankfort, Kentucky 40620

92A201 (6-16)

PART I—PROPERTY (Optional Listing)

Description and Location

of Real or Personal Property

Fair Cash Value at Date of Death

Total Value of Property |

|

PART II—BENEFICIARIES (Must be completed)

Relation to Decedent (Required)

If all taxable assets pass to exempt beneficiaries and a Federal Estate and Gift Tax Return is not filed, it is not necessary to file an InheritanceTax Return with the Kentucky Department of Revenue. An affidavit of exemption will be accepted by the courts for the final settlement and closing of the administration of an estate. If inheritance tax is due the Commonwealth of Kentucky, Form 92A200 or 92A205 should be used.

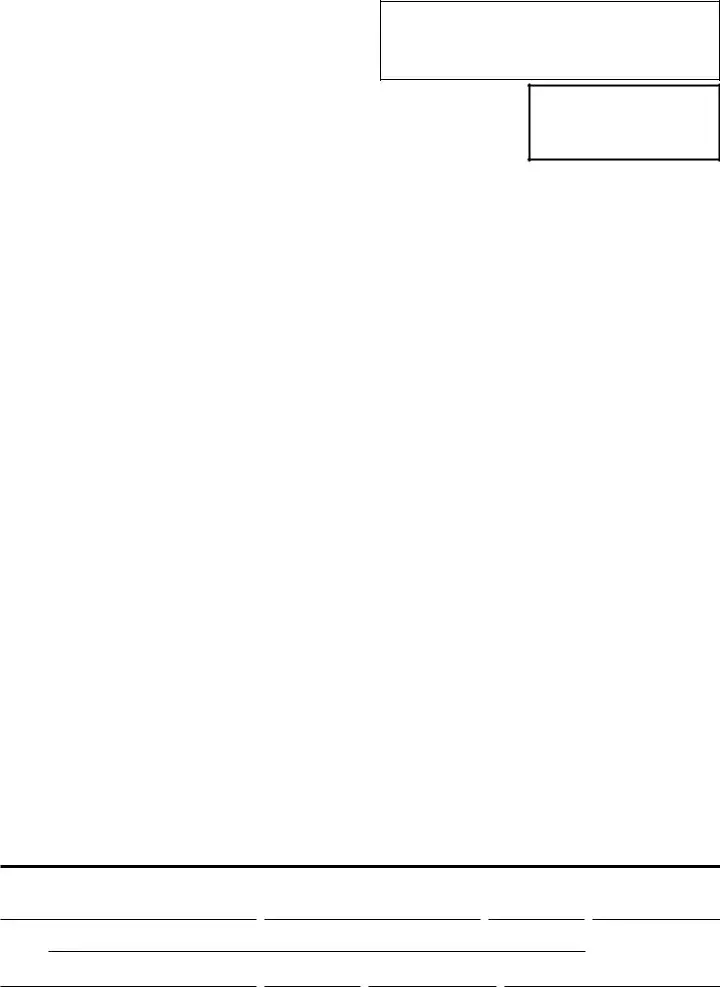

92A200 (6-16) |

KENTUCKY |

Commonwealth of Kentucky |

INHERITANCE TAX RETURN |

|

DEPARTMENT OF REVENUE |

|

FOR DEPARTMENT USE ONLY

|

4 |

6 |

|

|

__ __ __ __ __ __ / __ __ / __ __ / __ __ __ __ |

Account Number |

Tax |

Mo |

Year |

Requirements for use of this return—This return is to be filed when (1) the date of death is on or after January 1, 2005, (2) any assets of the estate pass to taxable beneficiaries or taxable organizations, (see page 4 of general information) and (3) Forms 92A201 and 92A205 do not apply. Pursuant to KRS 140.190, the beneficiaries as well as the personal representative(s) may be held personally liable for the tax.

Return Status (check one):

Original Return

Amended Return—Refund

Amended Return—Tax Due

|

Decedent’s Name |

Last |

First |

Middle Initial |

|

Occupation (If decedent was |

Age at Death |

Date of Death |

|

|

|

|

|

|

|

|

|

retired at death, state occu- |

|

|

|

|

|

|

|

|

|

|

|

|

|

pation prior to retirement.) |

|

|

|

|

|

Social Security Number |

|

|

|

|

|

|

|

|

|

Cause of Death |

HR Code Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Residence (Domicile) at Time of Death |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number and Street |

|

|

|

City |

|

|

State |

ZIP Code |

County |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and Address of Executor/Administrator/Beneficiary |

|

|

|

Name and Address of Preparer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exec |

|

|

|

|

|

|

|

Atty |

|

|

|

|

|

|

Admr |

|

|

|

|

|

|

|

CPA |

|

|

|

|

|

|

________ |

|

|

|

|

|

|

|

________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Did the decedent have a will? No |

Yes |

If Yes, attach a copy of the will. |

|

|

|

|

|

Did the decedent have a trust agreement? No |

Yes |

If Yes, attach a copy of the trust agreement. |

|

|

|

|

|

|

|

|

|

|

|

|

Filing status of Federal Estate and Gift Tax Return for this estate (check one): |

|

|

|

|

|

Not Required |

Required (enclose copy) |

Not Required, but filed for Portability (enclose copy) |

|

Gross Estate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. |

Individually owned assets |

|

|

|

|

|

$ |

|

|

|

|

|

|

2. |

Jointly owned assets |

|

|

|

|

|

$ |

|

|

|

|

|

|

3. |

Qualified terminable interest property |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

and/or powers of appointment |

|

|

|

|

|

$ |

|

|

|

|

|

|

4. |

Previously taxed property |

|

|

|

|

|

$ |

|

|

|

|

|

|

5. |

Gifts and transfers |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

Total Gross Estate |

|

|

|

|

|

|

|

$ |

|

|

Deductions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. |

Funeral expenses |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

7. |

Administration expenses |

...................................................................... |

|

|

|

|

|

$ |

|

|

|

|

|

|

8. |

Debts of decedent |

|

|

|

|

|

|

$ |

|

|

|

|

|

|

9. |

...................................Federal estate tax— paid or estimated |

|

|

|

|

$ |

|

|

|

|

|

|

|

|

|

Total Deductions |

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

Net Estate (Total Gross Estate less Total Deductions) |

|

$ |

|

|

|

|

|

Total Tax Due from Tax Computation Form 92A200 |

$ |

|

|

Interest and Penalty |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. |

Interest for late payment (see general information) |

.................................................................... |

|

|

|

|

|

|

$ |

|

|

11. |

Late filing penalty (see general information) |

|

|

|

|

|

|

|

$ |

|

|

12. |

Late payment penalty (see general information) |

|

|

|

|

|

|

$ |

|

|

13. |

Total Due (tax plus interest and penalties, if applicable) |

|

|

|

$ |

|

|

14. |

Total previously paid |

|

|

|

|

|

|

|

|

|

$ |

|

|

15. |

Balance due/Refund |

|

|

|

|

|

|

|

|

|

$ |

|

Attach check payable to “Kentucky State Treasurer” to this return and mail to Kentucky Department of Revenue, Frankfort, KY 40620

Under criminal penalties, I declare that this return, including accompanying documents, has been examined by me, and is, to the best of my knowledge and belief, true, correct and complete.

( )

Signature of Executor/Administrator/Beneficiary |

Social Security Number |

Date |

Telephone Number |

E-mail Address of Executor/Administrator/Beneficiary

( )

Signature of Preparer |

Date |

Telephone Number |

E-mail Address |

Estate of: |

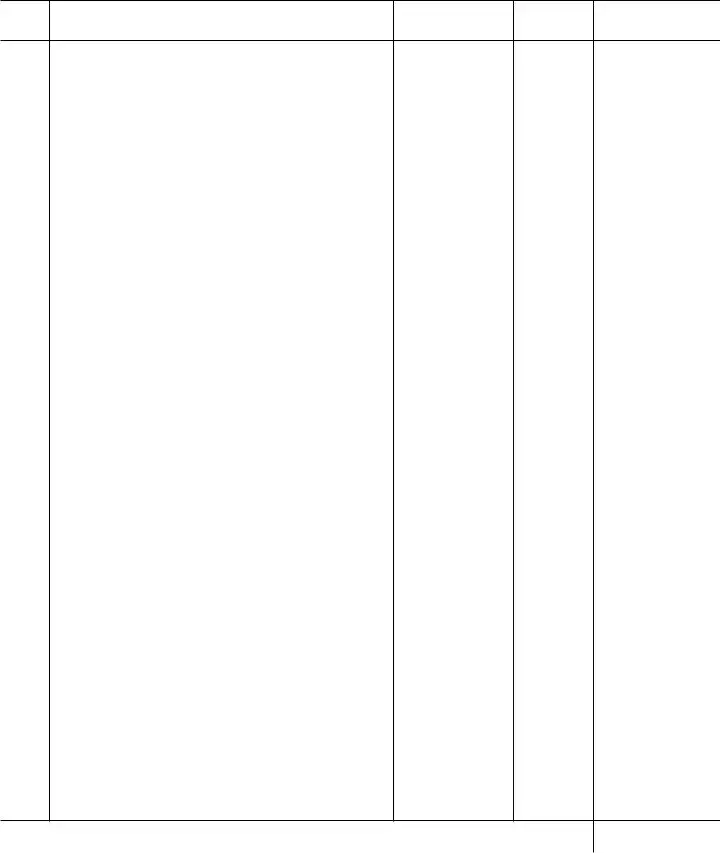

92A200 (6-16) |

|

|

|

Individually Owned Assets |

Page ____ of ____ |

|

|

List in this schedule all items individually owned by the decedent including life insurance payable to the estate.

(Please review instructions on reverse side for details.)

Item |

Description of Property/Name of Corporation |

Accrued Rents/ |

Number |

Fair Cash Value |

Number |

or Obligor/ Name of Bank or Debtor |

Interest/Dividends |

of Shares |

on Date of Death |

1.

Total (including continuation page(s)) (enter on page 1, line 1) |

|

|

|

If additional space is needed, duplicate this page and attach as a continuation page(s). |

|

INSTRUCTIONS

INDIVIDUALLY OWNED ASSETS

All real proper t y individually owned must b e lis ted in this schedule . For re por ting agricultural or horticultural land, see General Information—Valuation of Property—Fair Cash and Agricultural.

Stocks and bonds individually owned are includable in this schedule. Stock values are determined by using an average of the high and low quoted selling price on the decedent’s date of death. In case of inactive stock such as closely held corporations, explain the method used in computing the value at the date of death. A balance sheet, at a date nearest the decedent’s death, together with a statement of net earnings and dividends paid for the five-year period immediately preceding the date of death, must be supplied in support of these valuations (ex. financial institution’s monthly statement.)

Dividends declared and of record in the decedent’s name but not paid prior to death must be included in this schedule. Provide statements, lists, etc. supporting valuation of these assets.

United States bonds individually owned as well as those payable upon death to another should be included in this schedule. Indicate series, maturity value and date of purchase of all United States bonds.

In some instances, the estate will include stocks and bonds listed on a stock exchange that did not make sales on the date of the decedent’s death. When this occurs, their value must be determined by averaging the high and low for the last working day preceding the date of death and the first working day subsequent to the date of death. For reporting stock of a corporation owning qualified real estate passing to a qualified person(s), see General Information—Valuation of Property—Fair Cash and Agricultural.

Mortgages, notes and cash individually owned must be listed in this schedule. List accrued interest to date of death. The description of mortgages and notes must include interest rate, the date the last payment of interest was made preceding the date of the decedent’s death, and the due date

of the mortgages or notes. If an account is held out of state, show name and address of financial institution on the tax return.

List life insurance payable to the insured or to the estate. Life insurance payable to a designated beneficiary, including a testamentary or inter vivos trustee, is tax-free.

List in this schedule other individually owned items of the gross estate, such as debts due decedent; business or partnership (attach balance sheet showing capital accounts); claims, exclusive of those claimed under KRS 411.130 (wrongful death); rights; royalties; leaseholds; judgments; shares in trust funds; contracts; household goods and personal effects, including antiques, jewelry and collections of any type; farm products and growing crops; livestock; farm machinery; automobiles; etc.

The value of an annuity or other payment made to a beneficiary of a deceased employee (other than the executor or equivalent) under (1) an exempt trust or qualified nontrusted annuity plan as described by the Internal Revenue Code or (2) a contract purchased by an educational or charitable organization as referred to in Section 170(b)(1)(A)(ii) or (vi) of the Internal Revenue Code or a religious organization exempt from tax under Internal Revenue Code Section 501(a), is taxable in the proportion that the total contributions made by the decedent bears to the total contributions made. The proceeds from a Retired Serviceman’s Family Protection Plan or Survivor Benefit Plan are exempt under KRS 140.015(2). Refer to KRS 140.063(3) and (4) regarding the taxation of individual retirement accounts and annuities as described in Section 408(a) and (b) of the Internal Revenue Code. Lump-sum distributions of an IRA are taxable.

All other annuities, including deferred compensation plans, or payments other than those described in the preceding paragraph made to a beneficiary, executor or equivalent, are fully taxable if the decedent retained ownership at death such as the right to name or change the beneficiary and must be listed in this schedule.