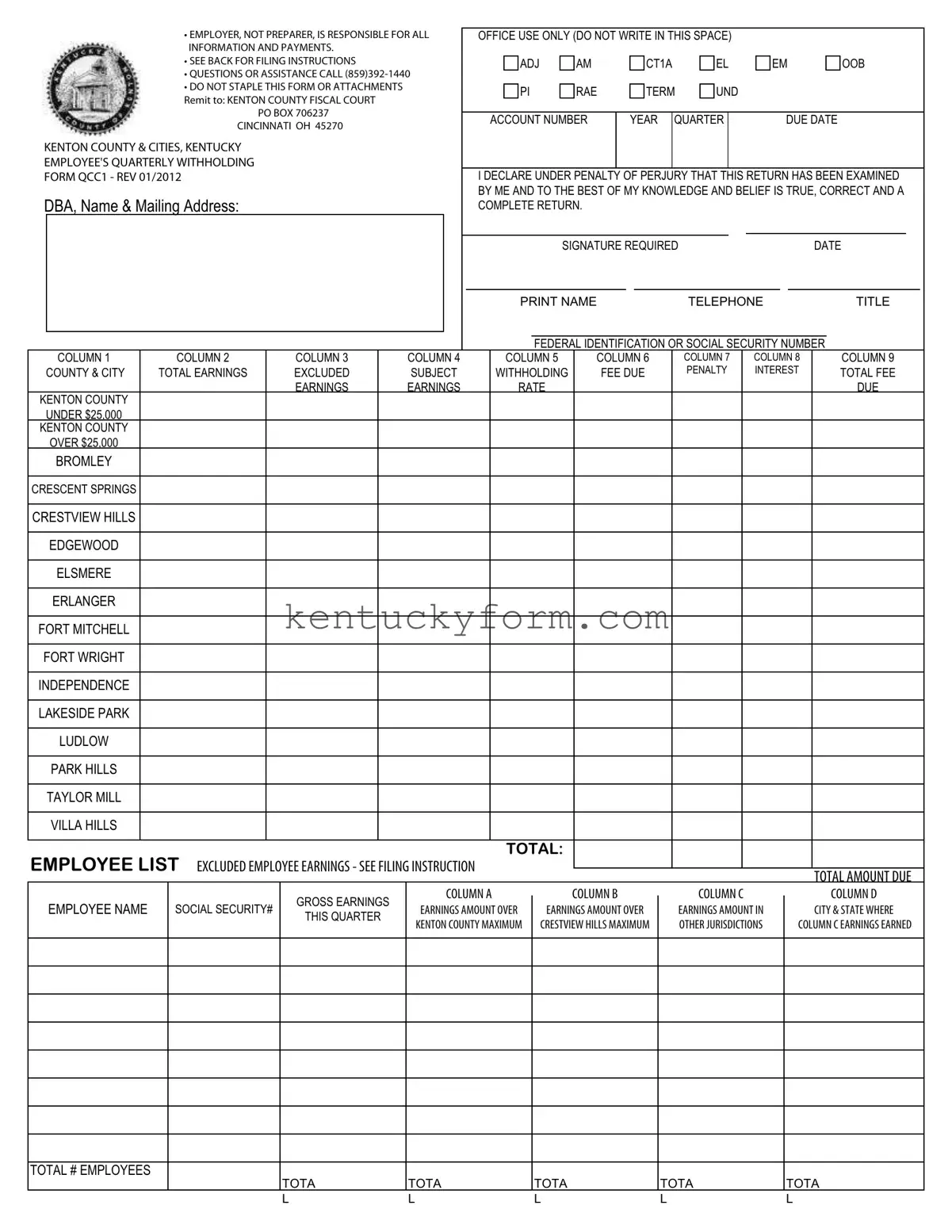

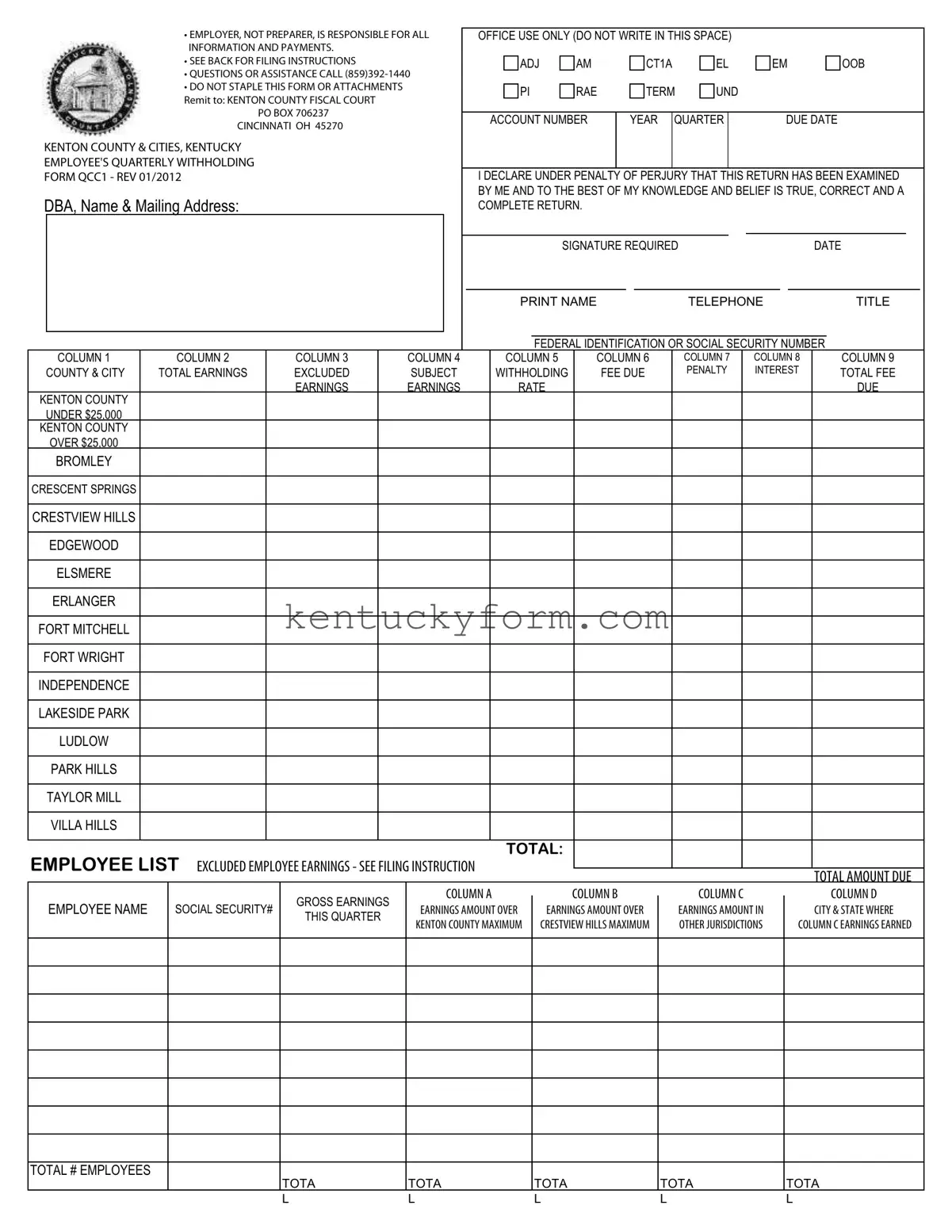

Kentucky Qcc1 PDF Template

The Kentucky Qcc1 form serves as an essential document for employers within Kenton County & Cities, Kentucky, specifically designed for reporting their employees' quarterly withholding taxes. It outlines a detailed process for documenting earnings, withholdings, and pertinent employer information, asserting that the responsibility for the accuracy of the information and payments solely rests with the employer. If you're an employer in Kenton County, ensure your compliance by carefully filling out the Qcc1 form today; click the button below to get started.

Modify Document

Kentucky Qcc1 PDF Template

Modify Document

Modify Document

or

Free Kentucky Qcc1 File

One quick step left to finish

Edit, save, and download Kentucky Qcc1 online with ease.