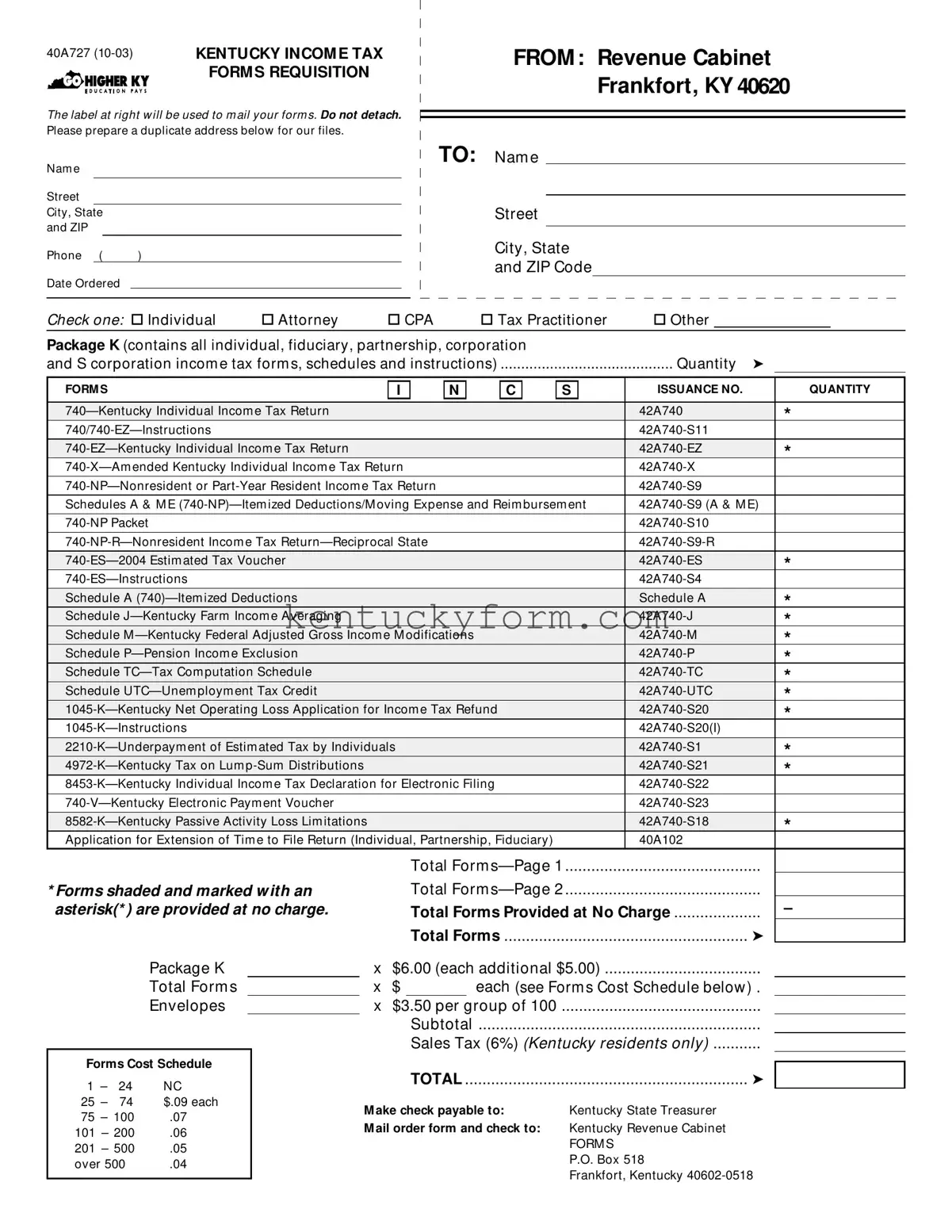

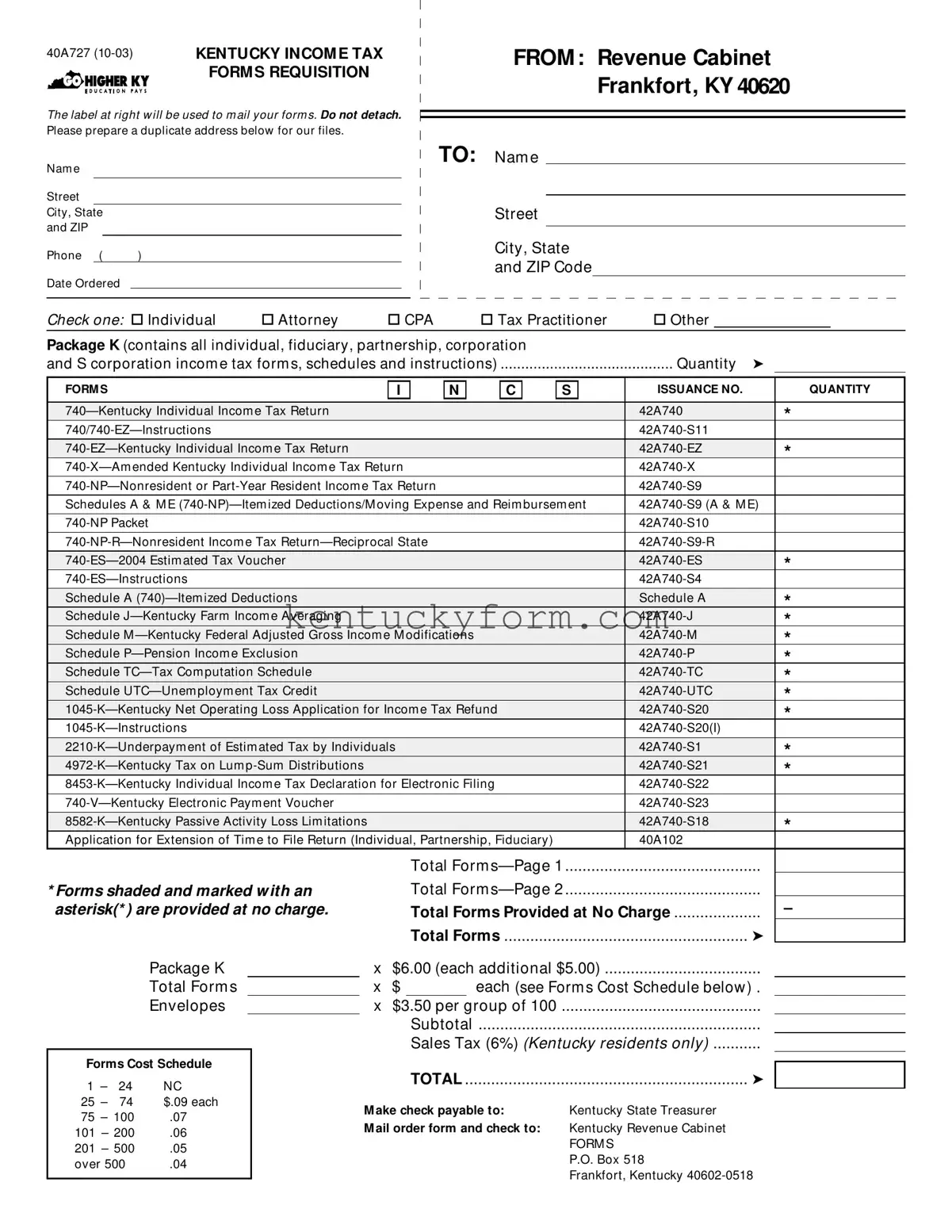

The IRS Form 1040, similar to the Kentucky 740—Kentucky Individual Income Tax Return, serves as the standard federal income tax form for individuals. Both forms are designed to calculate the tax owed or refund due to the taxpayer and include sections for reporting income, deductions, and tax credits. However, while the Kentucky 740 form focuses on state tax obligations, the IRS Form 1040 addresses federal tax requirements.

Form W-4, known as the Employee's Withholding Certificate, shares similarities with the Kentucky 740-ES—2004 Estimated Tax Voucher. Both forms involve the estimation and adjustment of taxes paid throughout the year. The Kentucky 740-ES helps individuals estimate state taxes due, facilitating proper quarterly payments, whereas the Form W-4 assists employers in withholding the correct federal income tax from employees' paychecks.

The IRS Form 4868, Application for Automatic Extension of Time To File U.S. Individual Income Tax Return, parallels the Application for Extension of Time to File Return found within the Kentucky Tax Requisition form package. Each form provides individuals the means to request additional time to file their respective tax returns—Form 4869 at the federal level and the state form for Kentucky filers—though neither extends the time for tax payment.

The Schedule K-1 forms within the IRS and Kentucky tax frameworks serve analogous purposes but in different contexts. The Kentucky Schedule K-1 (741) and (765) allocations are akin to the federal Schedule K-1 forms for partnerships, S corporations, and trusts, detailing a beneficiary's share of income, deductions, and credits. This arrangement ensures transparency in reporting pass-through entities' income on individual tax returns.

Form 8822, Change of Address, issued by the IRS, corresponds to the administrative process implied by the Kentucky Tax Requisition form for updating taxpayer contact information. While the Kentucky form indirectly facilitates updating addresses through the ordering of tax forms, IRS Form 8822 directly updates taxpayer records with the federal government to ensure accurate correspondence delivery.

IRS Form 1120, U.S. Corporation Income Tax Return, aligns with the Kentucky 720—Kentucky Corporation Income and License Tax Return in its function to report corporate income taxes. Each form is tailored to its respective tax authority's requirements, with Form 1120 catering to federal tax obligations and the Kentucky 720 addressing the state's corporate tax structure.

IRS Form 7004, Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns, finds its counterpart in the Kentucky Application for Extension of Time to File KY Corporation Income and License Tax Return. Though one is for federal purposes and the other for state, both forms serve the crucial role of granting businesses additional time to compile and file detailed tax documents.

The IRS Form 2553, Election by a Small Business Corporation, has similarities with the Kentucky 720S—Kentucky S Corporation Income and License Tax Return and related schedules in terms of facilitating S corporation tax status. While Form 2553 is used to elect S corporation status at the federal level, the Kentucky 720S documents and their schedules manage the state-level tax implications of such an election, including income, deductions, and credit allocations among shareholders.

Form 9465, IRS Installment Agreement Request, is comparable to the Kentucky Individual Income Tax Installment Agreement Request form. Both exist to assist taxpayers in setting up payment plans for outstanding tax liabilities, providing a structured approach to settling debts over time with their respective tax authorities.

Lastly, the IRS Form 1045, Application for Tentative Refund, relates to the 1045-K—Kentucky Net Operating Loss Application for Income Tax Refund in its framework for managing losses. Each form allows for the carryback of net operating losses (NOLs), enabling taxpayers to amend previous years’ returns with current losses to secure potential refunds. The key difference is the jurisdiction in which the forms apply, with the IRS form addressing federal tax situations and the Kentucky form handling state tax matters.