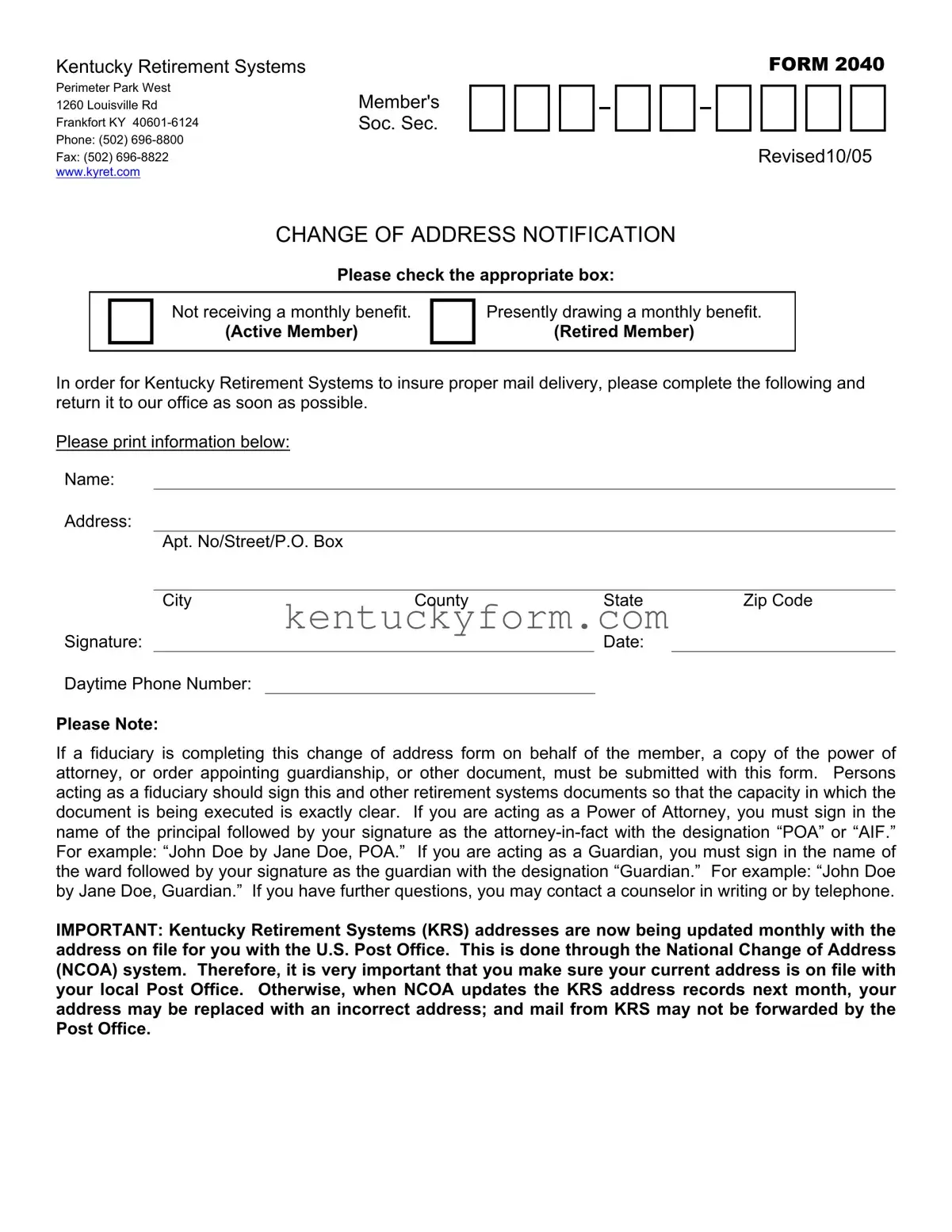

The Kentucky Retirement Systems FORM 2040 shares similarities with forms used by other state retirement systems for address changes. Like its counterparts, this form requires the member to provide current address information and specify their status as either an active member or a retired beneficiary. This commonality ensures that retirement systems can update their records to maintain accurate communication with their members. The primary function of these forms across different states lies in their role to facilitate updated information flow, making sure that important documents, notifications, and benefits reach the intended recipients without delay.

Change of address forms provided by financial institutions, including banks and investment firms, parallel the Kentucky form in several respects. These documents collect contact information updates to prevent service interruptions and ensure the security of clients’ financial assets. Just as the Kentucky form specifies the need for a daytime phone number and a signature for verification, financial institutions' forms implement similar measures to verify the identity of the person making the request and to maintain the integrity of account information, reflecting an industry-wide standard for client communication and account management.

Insurance companies utilize change of address forms that share the Kentucky form's objective of up-to-date record keeping. Whether for health, auto, or life insurance, these forms help ensure that policyholders receive pertinent information regarding their coverage and that there is no lapse in communication that might affect claims or policy adjustments. The requirement to submit legal documentation when a fiduciary acts on the policyholder's behalf is consistent with the guidelines outlined in the Kentucky form, emphasizing the importance of clear and authorized representations in contractual relationships.

The Internal Revenue Service (IRS) uses a form for notifying a change of address that serves a similar purpose to the Kentucky form. This parallel is seen in the necessity of keeping current addresses on file to receive tax documents, notices, and refunds. Moreover, the Kentucky form's emphasis on submitting fiduciary documentation finds a counterpart in how the IRS requires clear authorization for individuals acting on behalf of another taxpayer, underlining the necessity of maintaining strict controls over personal and sensitive information.

Change of address notifications required by the U.S. Postal Service (USPS) for mail forwarding similarly reflect the operations of the Kentucky Retirement Systems form in their function to update contact information to ensure mail delivery accuracy. The automated process through the National Change of Address (NCOA) system mentioned in the Kentucky form highlights a shared reliance on contemporary data management practices to keep address records current, which is crucial for uninterrupted service and personal correspondence.

Employer-based human resources departments frequently use forms that mirror the structure and purpose of the Kentucky Retirement Systems form for updating employee records. These forms ensure that employees receive vital information regarding employment benefits, tax documents, and other official communications. The similarity includes the need for accurate contact information and the provision for representatives to act on behalf of the individual, securing the flow of information within the corporate or institutional context.

Voter registration change of address forms share the emphasis on ensuring current address information for official records, akin to the Kentucky form. This ensures that individuals receive timely and pertinent electoral communications, absentee ballots, and other relevant notices pertaining to their civic duties. This alignment underscores the broader importance of accurate and current address information across various facets of public and private administration for sustaining active participation and compliance.

Utility companies' change of address forms, required for updating billing and service locations, also share similarities with the Kentucky Retirement Systems FORM 2040. Ensuring that billing addresses are up-to-date to prevent service interruptions or billing issues reflects a mutual objective with the Kentucky form. Both types of forms facilitate the continuous access to essential services and financial obligations, reinforcing the critical nature of accurate address information in service provision and financial transactions.

Lastly, subscription services frequently employ change of address forms to ensure continuous delivery and service satisfaction, mirroring the functional essence of the Kentucky form. These forms prevent disruptions in the receipt of periodicals, online access, or other subscribed services, highlighting the universal importance of current address information for maintaining the quality and continuity of service across diverse sectors.