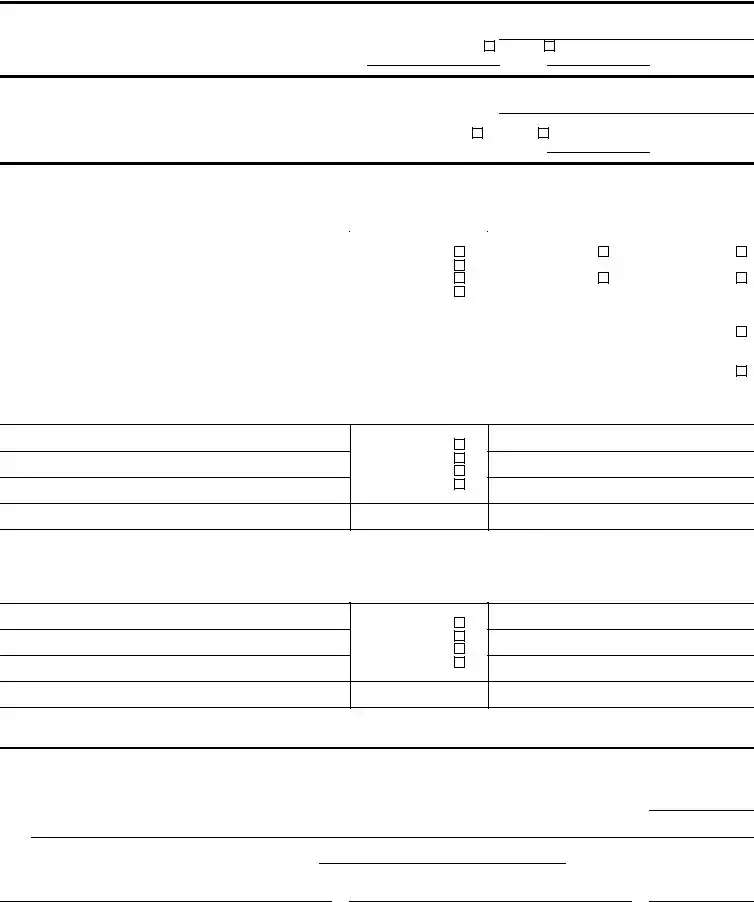

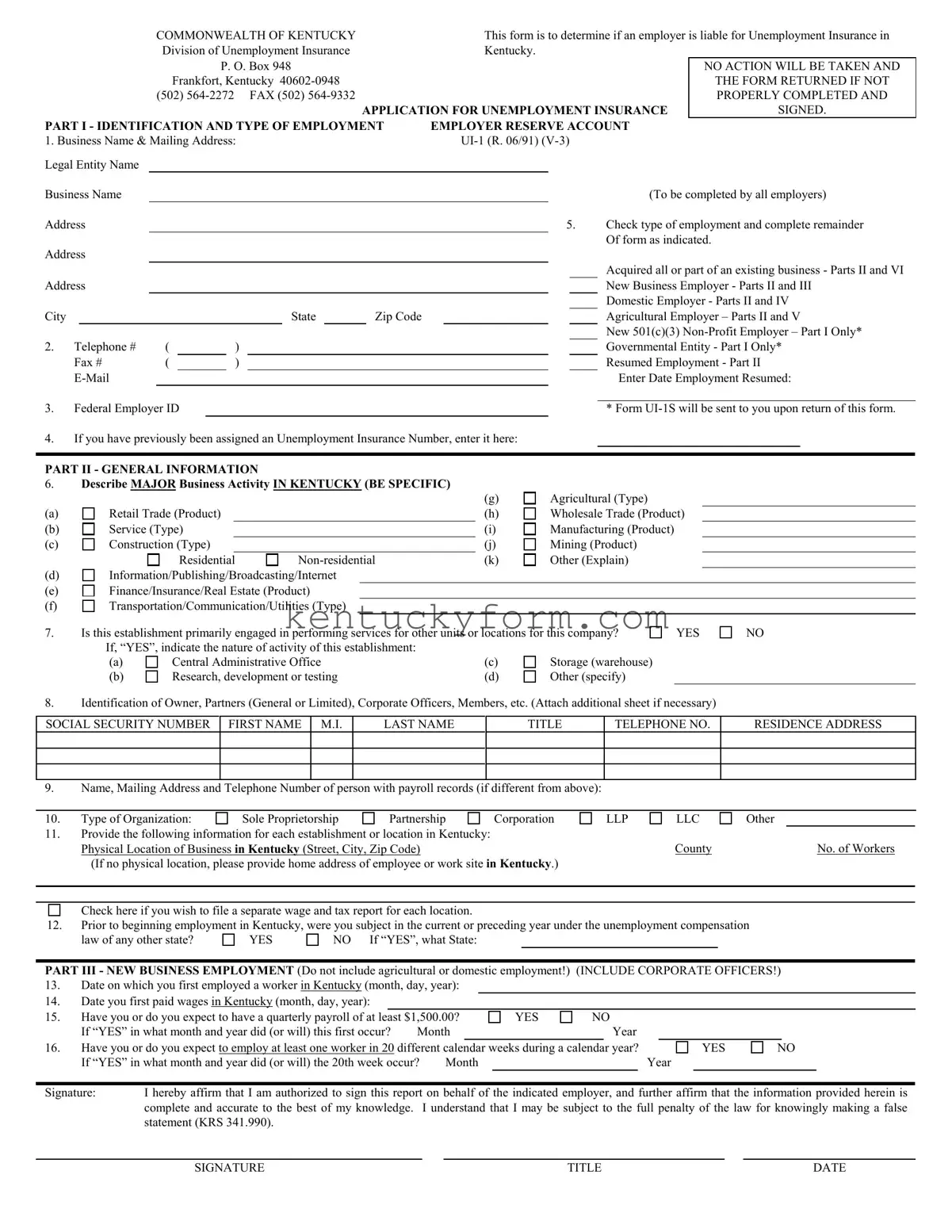

The Kentucky UI-1 form, required for determining an employer's unemployment insurance liability in Kentucky, has parallels with several other documents used in different states and contexts. Notably, it shares similarities with documents involved in determining tax obligations and regulatory compliance for businesses. This educational walkthrough will explore nine documents similar to the Kentucky UI-1 Form, shedding light on their purposes and the ways in which they align.

Firstly, the IRS Form SS-4, Application for Employer Identification Number (EIN), is quite similar to the Kentucky UI-1 form. Both forms are crucial for new businesses, with the Form SS-4 being necessary for obtaining an EIN that entities need for tax filing and reporting purposes. Similar to the UI-1, it collects identification and business activity information, although its primary focus is on federal tax identification rather than state unemployment insurance.

Secondly, the New York NYS-100, Employer Registration for Unemployment Insurance, Withholding, and Wage Reporting, resembles the Kentucky UI-1 form in its multi-purpose approach to registering new employers for various state obligations. Like the UI-1, the NYS-100 gathers comprehensive details about the business, its activities, and employment structure to assist in unemployment insurance liability determination, among other things.

Another document, the California DE-1, Registration Form for Commercial Employers, also mirrors the UI-1 form's function by collecting information from employers to establish their account with the state's Employment Development Department. This form is vital for unemployment insurance, state disability insurance, and employment tax purposes in California, showcasing a multi-faceted approach similar to that of the Kentucky UI-1.

The Texas C-1, Employer’s Quarterly Federal Tax Return, though primarily focused on tax reporting, shares the foundational need of the Kentucky UI-1 form to collect employer information for the purpose of financial obligation compliance. Both documents play vital roles in a business’s operation within their respective state’s regulatory and tax frameworks.

The Florida UCT-6, Employer’s Quarterly Report, serves a similar function to the Kentucky UI-1 by collecting employment and wage data to determine unemployment insurance contributions. The emphasis on accurate employer and employee data parallels the UI-1's objective of establishing a clear and compliant reporting relationship with the state.

The Illinois UI-1, Report to Determine Liability Under the Unemployment Insurance Act, directly corresponds with Kentucky's UI-1 in both name and purpose. It marks the first step for Illinois employers to register with the state for unemployment insurance, closely matching the procedural and informational aspects found in Kentucky’s UI-1 form.

The Form I-9, Employment Eligibility Verification, though a federal document and not specific to any state, shares the goal of employer compliance through proper documentation. Unlike the UI-1, which focuses on unemployment insurance, the I-9 ensures employees are legally eligible to work in the United States, highlighting the overarching theme of regulatory compliance in employer-employee relations.

The Pennsylvania UC-1, Pennsylvania Unemployment Compensation Employer Registration, is utilized to determine an employer’s liability for state unemployment insurance, much like the Kentucky UI-1. This document underscores the necessity for employers to register with state unemployment systems to ensure the proper allocation of unemployment benefits.

Finally, the Washington State Business License Application mirrors aspects of the Kentucky UI-1 by serving as a comprehensive tool for business registration and regulatory compliance across various state agencies. While covering a broader scope, it aligns with the UI-1’s role in guiding businesses through the legal requirements for operating within the state.

Each of these documents, despite serving unique purposes or tailored to specific state regulations, shares the common goal of ensuring businesses meet their legal and financial obligations. In doing so, they support a structured approach to business operations, employee management, and regulatory compliance.

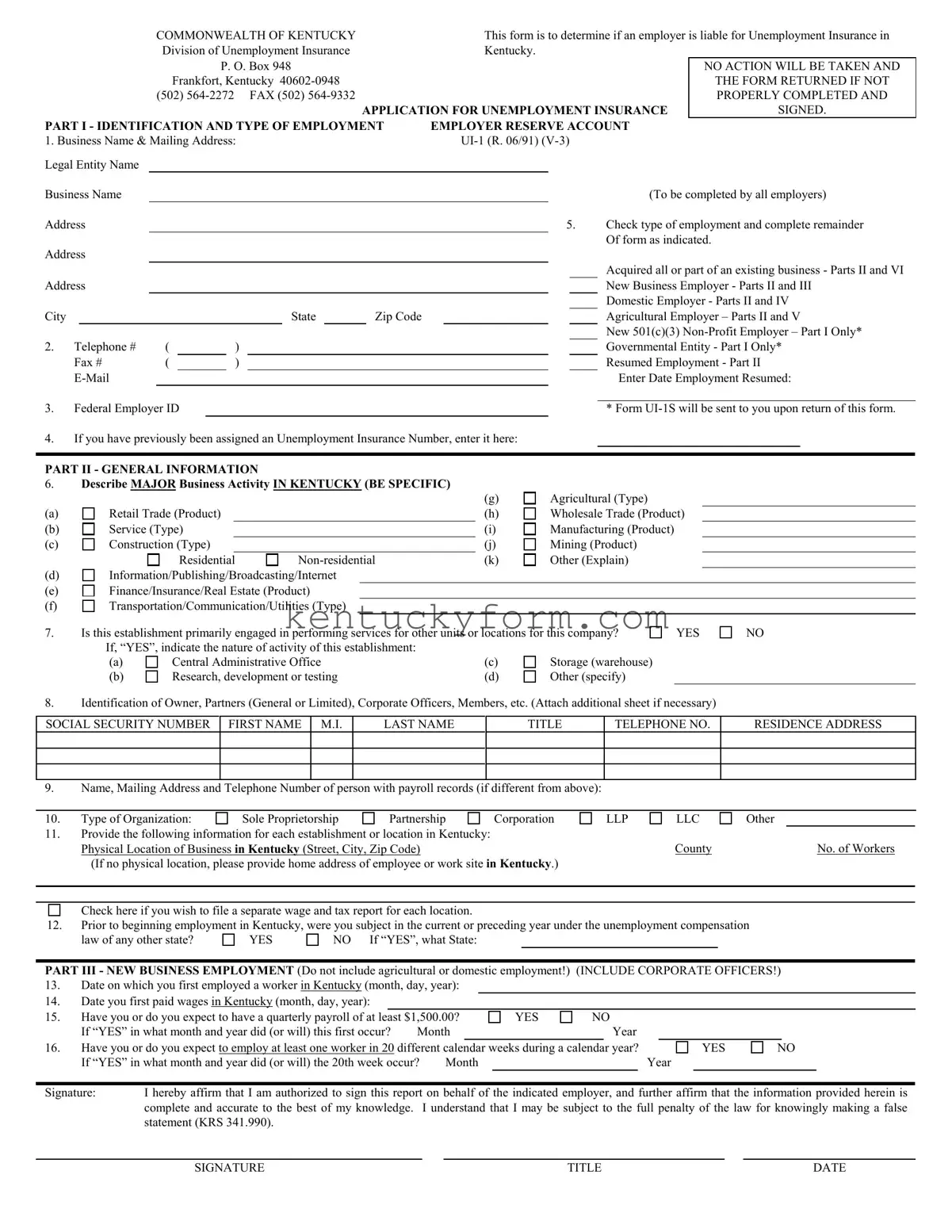

Information/Publishing/Broadcasting/Internet

Information/Publishing/Broadcasting/Internet