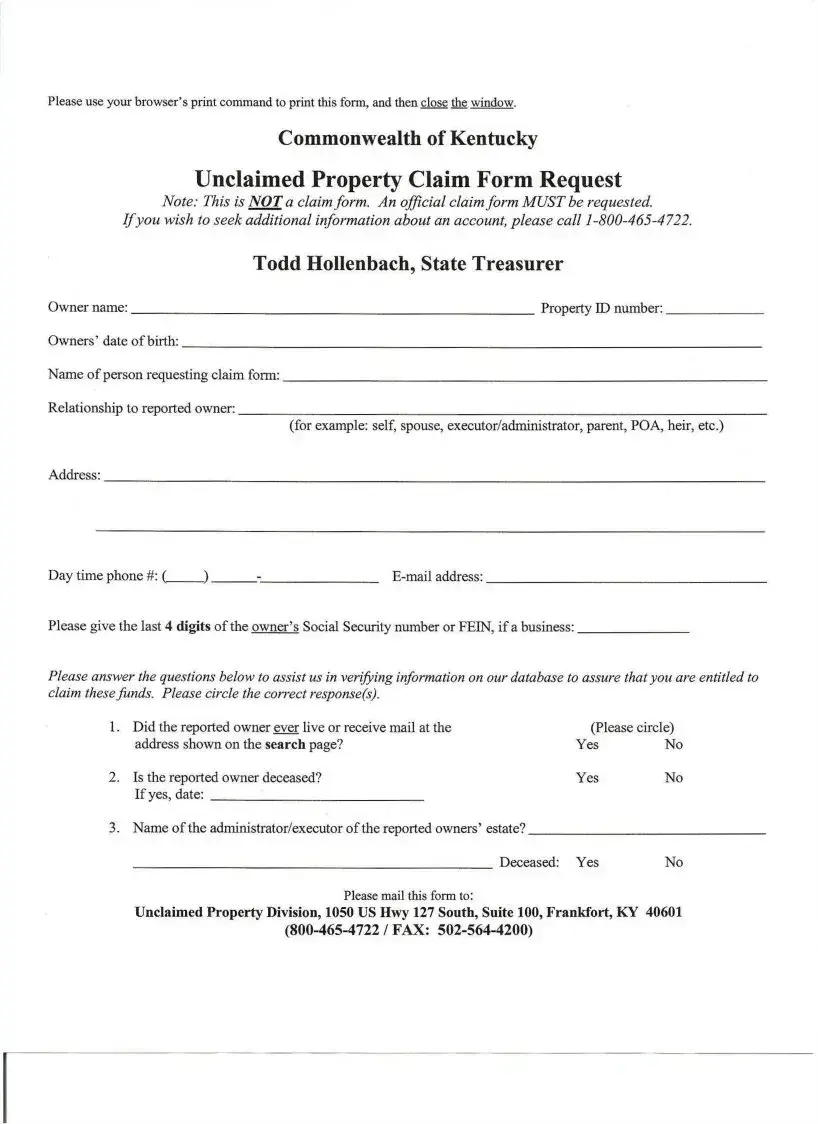

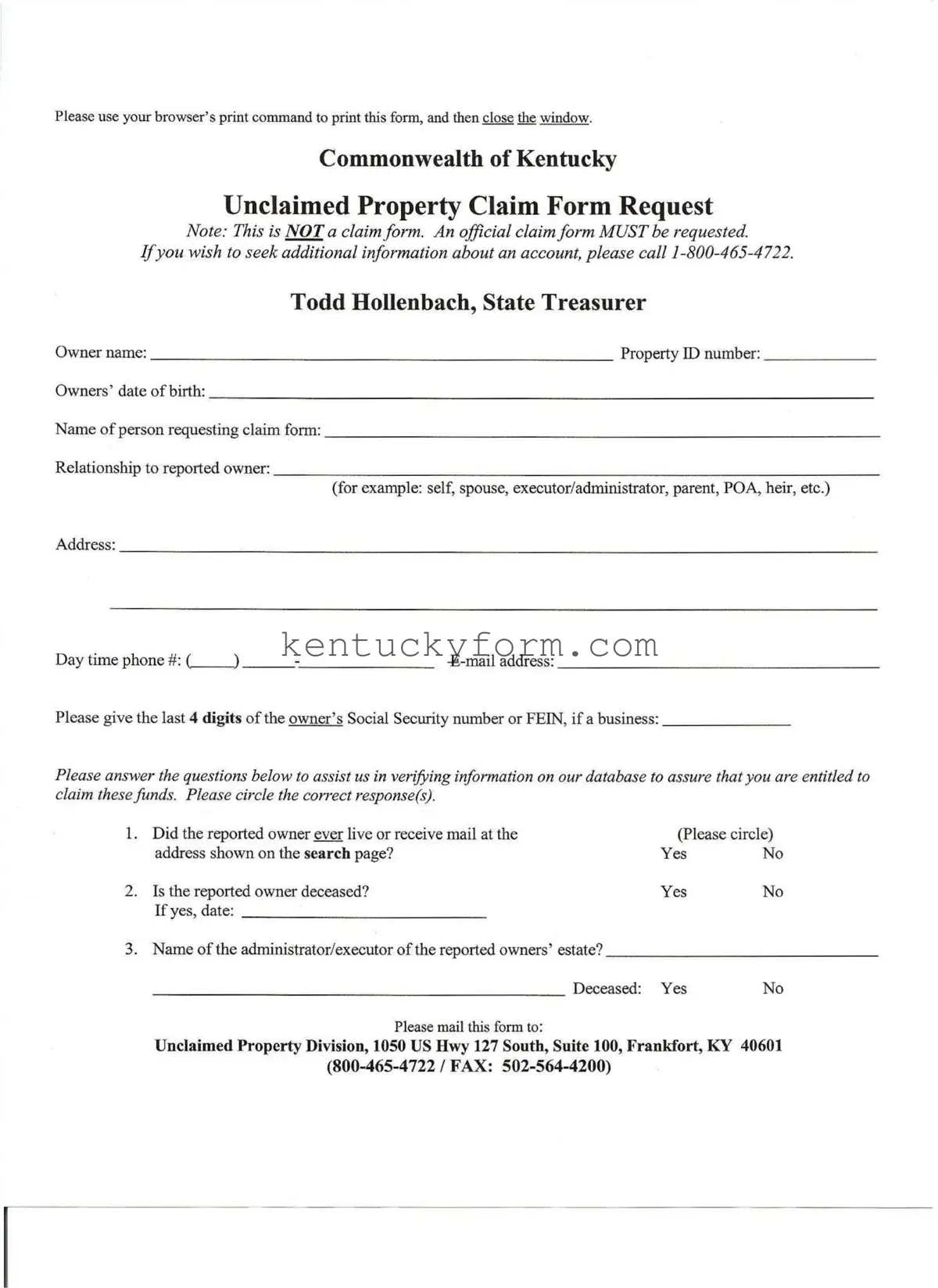

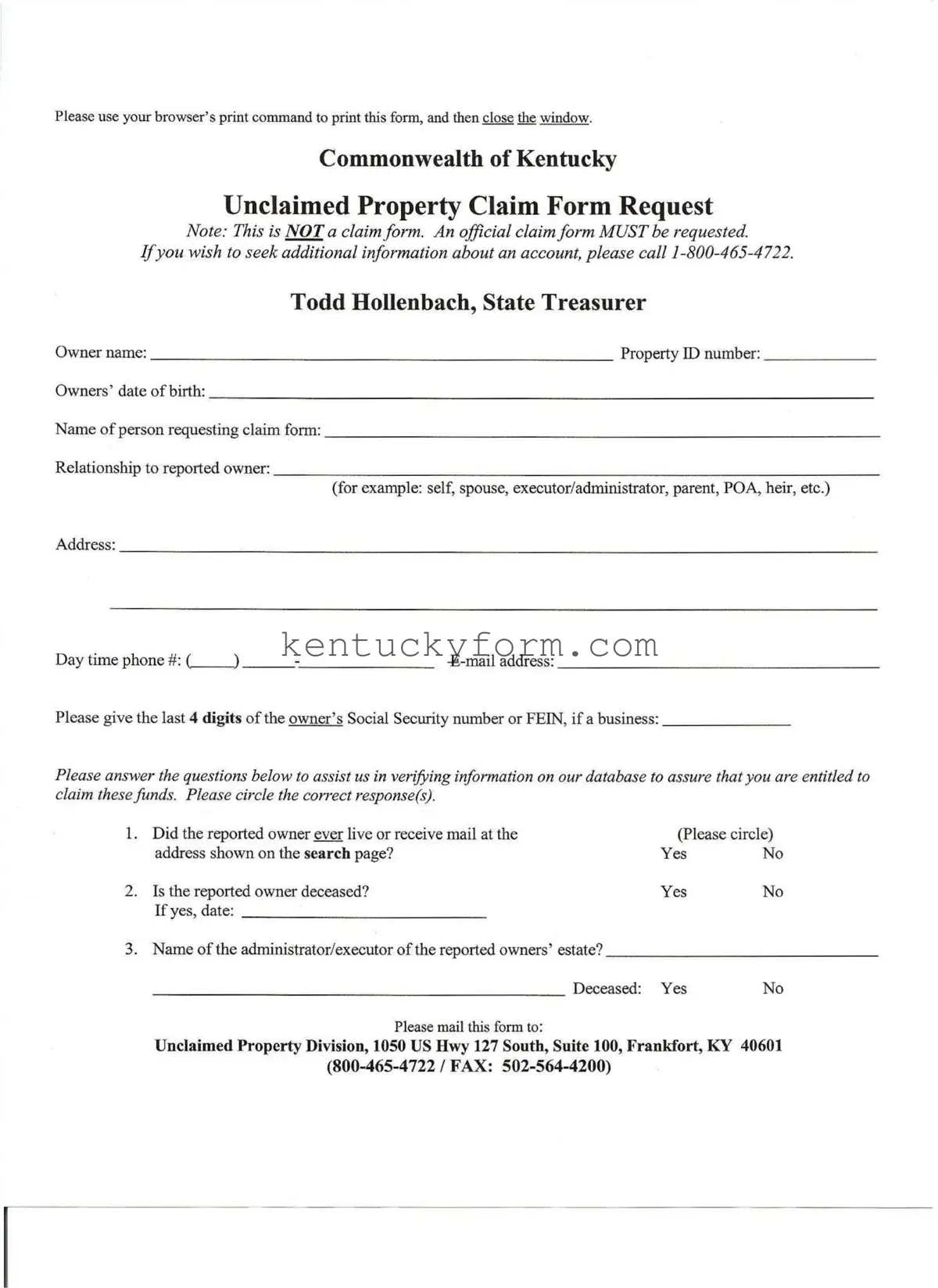

Kentucky Unclaimed Property Reporting PDF Template

The Kentucky Unclaimed Property Reporting form is a crucial document that businesses use to report personal property that has been abandoned or unclaimed. This form ensures that unclaimed assets are properly accounted for and can be returned to their rightful owners. To ensure these assets do not remain in limbo, consider filling out the form by clicking the button below.

Modify Document

Kentucky Unclaimed Property Reporting PDF Template

Modify Document

Modify Document

or

Free Kentucky Unclaimed Property Reporting File

One quick step left to finish

Edit, save, and download Kentucky Unclaimed Property Reporting online with ease.