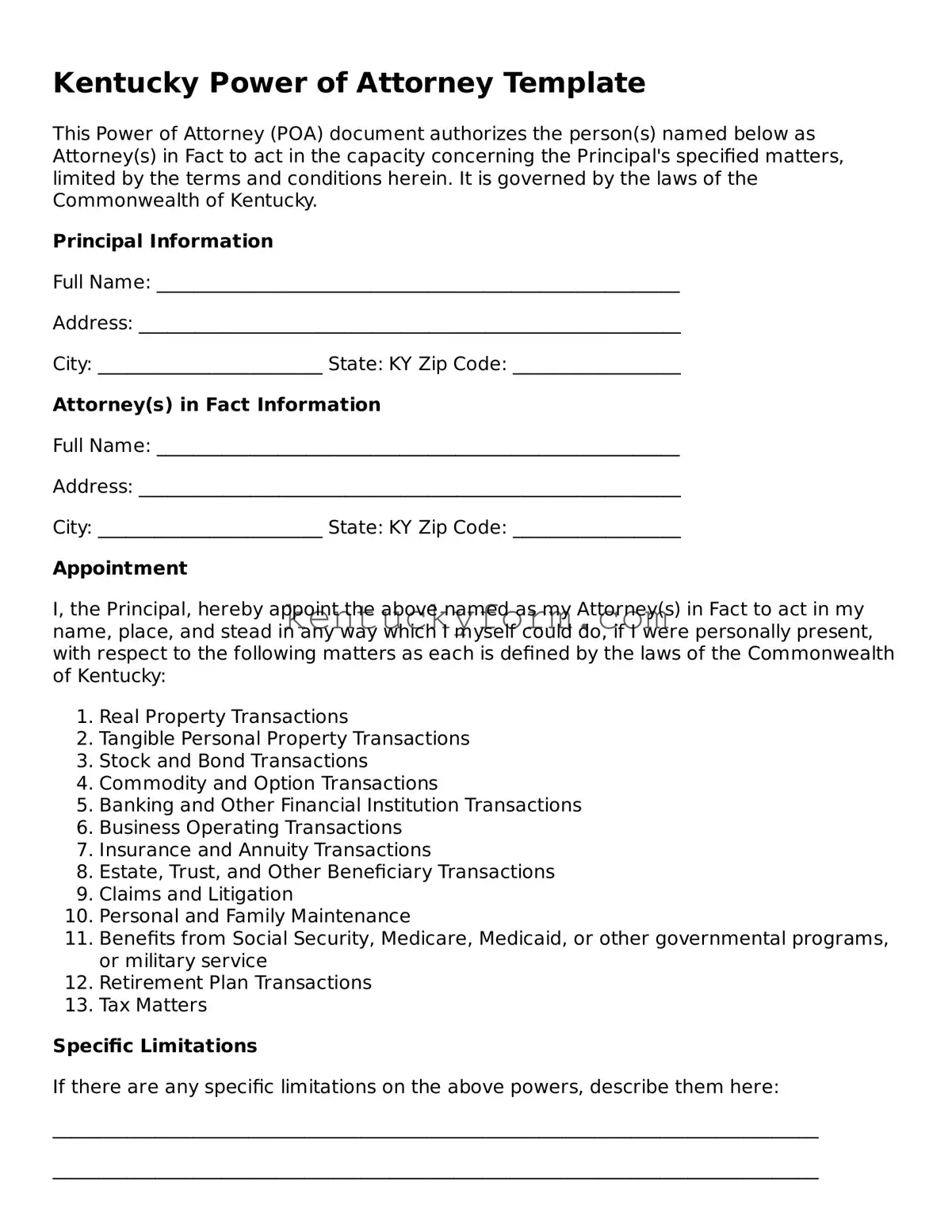

Kentucky Power of Attorney Template

This Power of Attorney (POA) document authorizes the person(s) named below as Attorney(s) in Fact to act in the capacity concerning the Principal's specified matters, limited by the terms and conditions herein. It is governed by the laws of the Commonwealth of Kentucky.

Principal Information

Full Name: ________________________________________________________

Address: __________________________________________________________

City: ________________________ State: KY Zip Code: __________________

Attorney(s) in Fact Information

Full Name: ________________________________________________________

Address: __________________________________________________________

City: ________________________ State: KY Zip Code: __________________

Appointment

I, the Principal, hereby appoint the above named as my Attorney(s) in Fact to act in my name, place, and stead in any way which I myself could do, if I were personally present, with respect to the following matters as each is defined by the laws of the Commonwealth of Kentucky:

- Real Property Transactions

- Tangible Personal Property Transactions

- Stock and Bond Transactions

- Commodity and Option Transactions

- Banking and Other Financial Institution Transactions

- Business Operating Transactions

- Insurance and Annuity Transactions

- Estate, Trust, and Other Beneficiary Transactions

- Claims and Litigation

- Personal and Family Maintenance

- Benefits from Social Security, Medicare, Medicaid, or other governmental programs, or military service

- Retirement Plan Transactions

- Tax Matters

Specific Limitations

If there are any specific limitations on the above powers, describe them here:

__________________________________________________________________________________

__________________________________________________________________________________

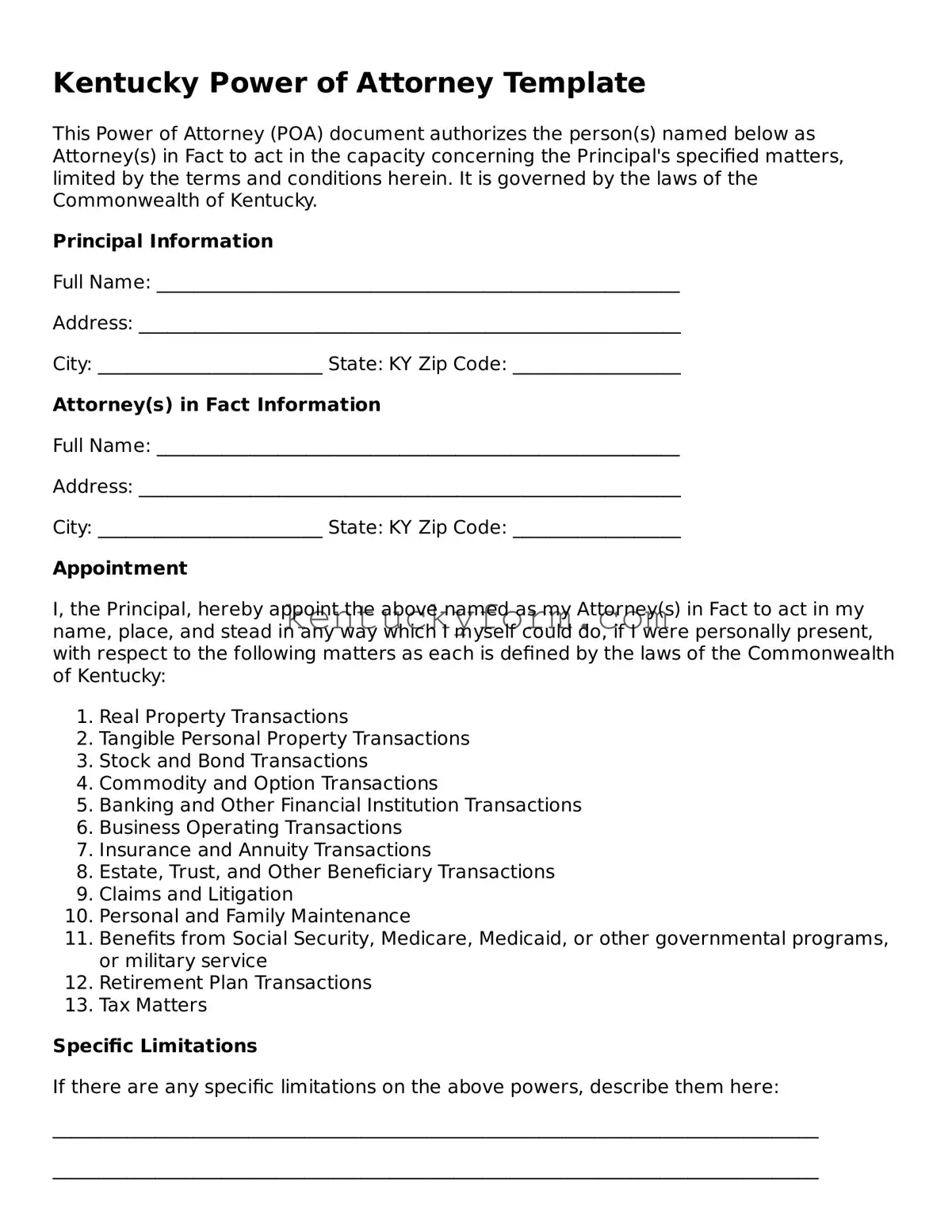

Effective Date and Duration

This Power of Attorney shall become effective on the date of ________________________, 20____, and shall remain effective until it is revoked by the Principal or otherwise terminated by law.

Third Party Reliance

Third parties may rely upon the representations of the Attorney(s) in Fact as to all matters relating to any power granted to them under this document.

Revocation

This Power of Attorney may be revoked by the Principal at any time by providing written notice to the Attorney(s) in Fact.

Signatures

_________________________________ _________________________________

Signature of Principal Date

_________________________________ _________________________________

Signature of Attorney(s) in Fact Date

Witness Declaration

We, the undersigned, declare that the Principal is personally known to us, that the Principal signed or acknowledged this Power of Attorney in our presence, that the Principal appears to be of sound mind and under no duress, fraud, or undue influence, that we are not the person(s) appointed as Attorney(s) in Fact by this document, and that we are not related to the Principal by blood or marriage.

_________________________________ _________________________________

Signature of Witness #1 Date

_________________________________ _________________________________

Signature of Witness #2 Date

Notarization

This document was acknowledged before me on (date) ____________________ by (names of Principal and Attorney(s) in Fact ______________________________________.

_________________________________ _________________________________

Notary Public Signature Date

My commission expires: __________________________________