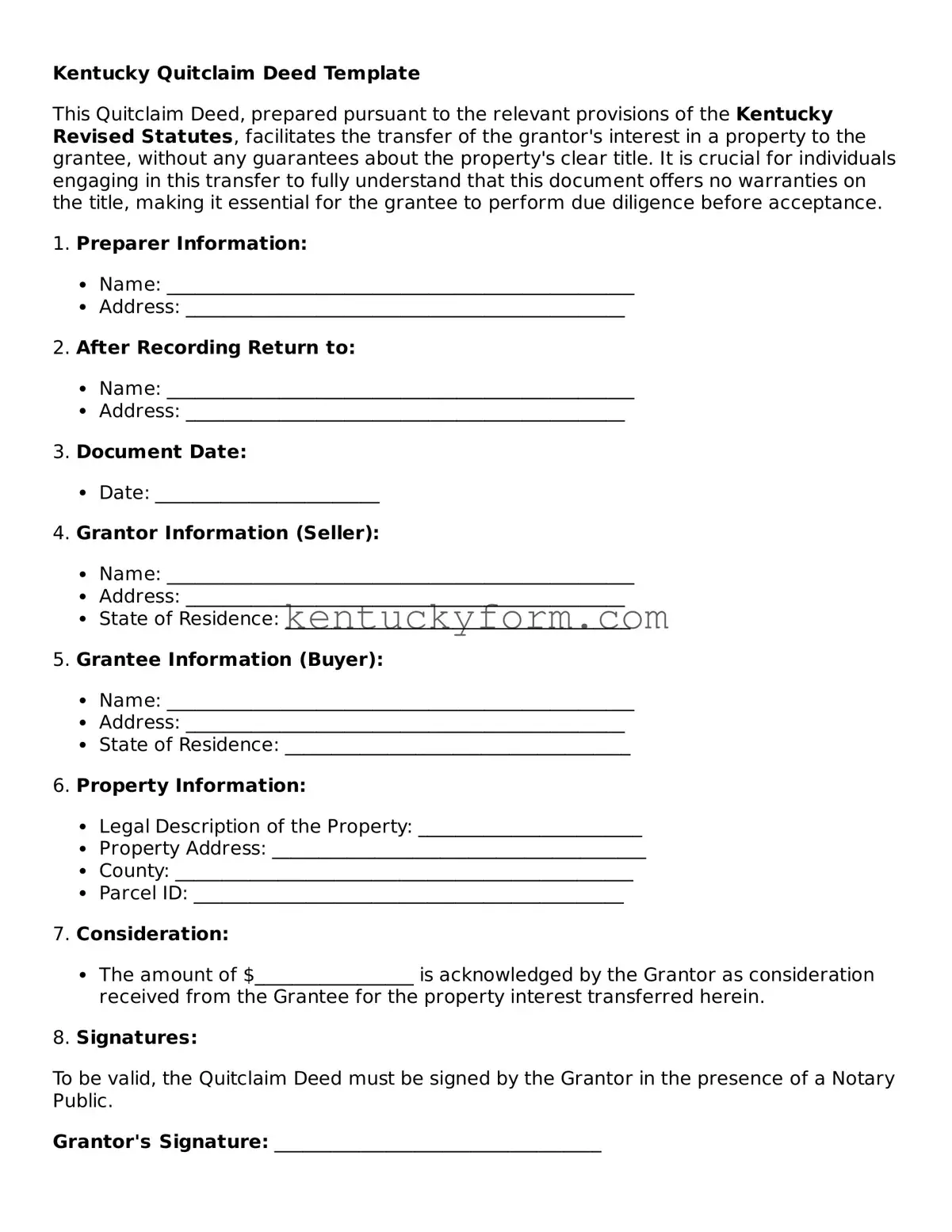

Kentucky Quitclaim Deed Template

This Quitclaim Deed, prepared pursuant to the relevant provisions of the Kentucky Revised Statutes, facilitates the transfer of the grantor's interest in a property to the grantee, without any guarantees about the property's clear title. It is crucial for individuals engaging in this transfer to fully understand that this document offers no warranties on the title, making it essential for the grantee to perform due diligence before acceptance.

1. Preparer Information:

- Name: __________________________________________________

- Address: _______________________________________________

2. After Recording Return to:

- Name: __________________________________________________

- Address: _______________________________________________

3. Document Date:

- Date: ________________________

4. Grantor Information (Seller):

- Name: __________________________________________________

- Address: _______________________________________________

- State of Residence: _____________________________________

5. Grantee Information (Buyer):

- Name: __________________________________________________

- Address: _______________________________________________

- State of Residence: _____________________________________

6. Property Information:

- Legal Description of the Property: ________________________

- Property Address: ________________________________________

- County: _________________________________________________

- Parcel ID: ______________________________________________

7. Consideration:

- The amount of $_________________ is acknowledged by the Grantor as consideration received from the Grantee for the property interest transferred herein.

8. Signatures:

To be valid, the Quitclaim Deed must be signed by the Grantor in the presence of a Notary Public.

Grantor's Signature: ___________________________________

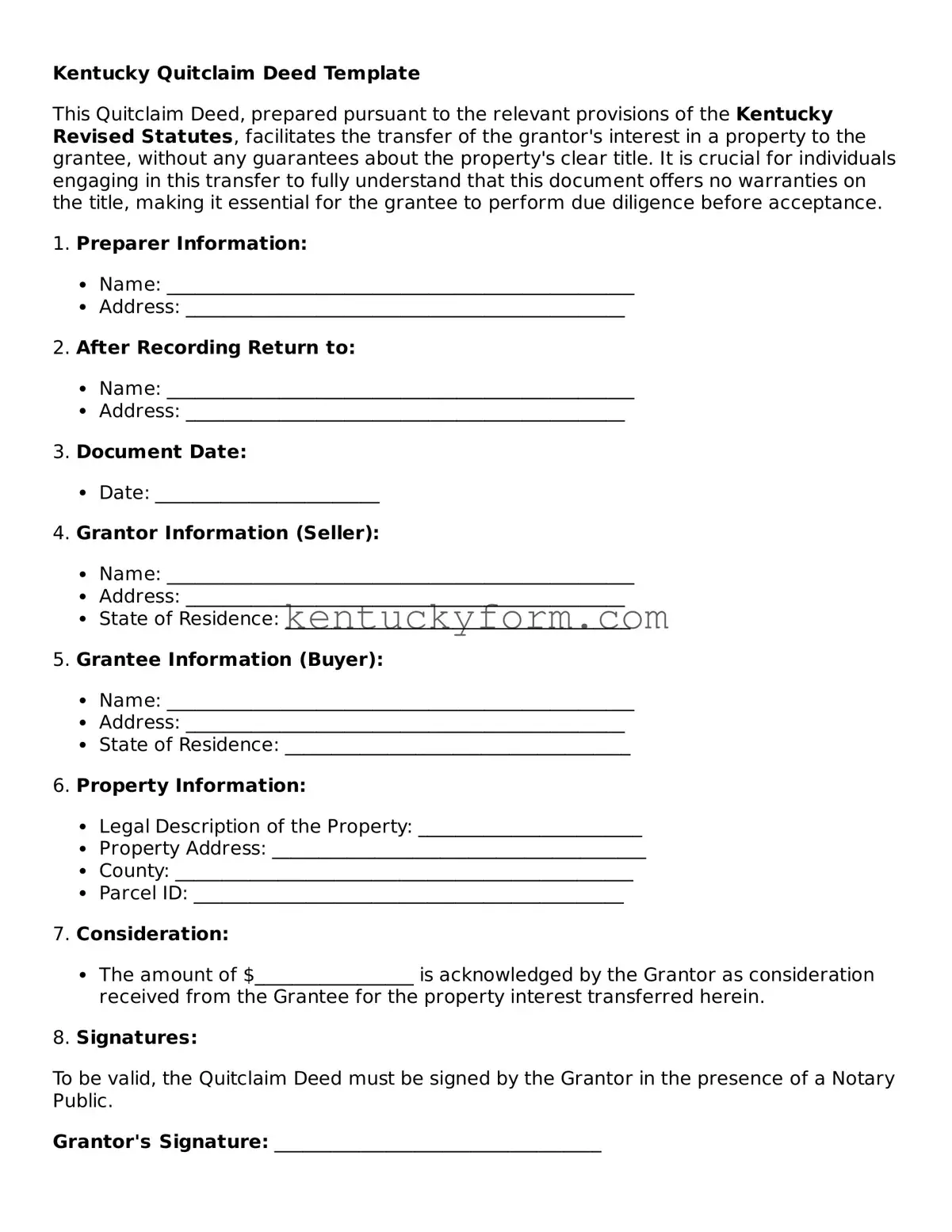

Date: ________________________

State of Kentucky

County of ___________________

On this, the _____ day of ____________________, 20____, before me, _______________________________, a Notary Public in and for said County and State, personally appeared _________________________________, known to me (or satisfactorily proven) to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged that he/she/they executed the same for the purposes therein contained.

In my presence and hearing, the Grantor has declared and confirmed that this Quitclaim Deed is executed as his/her/their voluntary act and deed.

Witness my hand and official seal:

_________________________________________________ (Seal)

Notary Public

My Commission Expires: _________________